When an attorney receives money from a client, he’ll want to deposit it into the correct bank account. Whether the money should be in the trust account or the operating account depends on the answer to this question: To whom does this money belong right now?

If the answer is: the client or some other 3rd party, then the money must be deposited into the trust account.

If the answer is: the attorney, then the money goes into the firm’s operating account.

And if the answer is: both the client and the attorney, it must be put into the trust account and the part belonging to the attorney is withdrawn when earned.

Learn about the five most common types of legal fees Arizona attorneys receive and how they impact trust accounts.

1. Advanced Fee

An advanced fee is any fee you receive to complete future services. The fee will be earned at an agreed-upon basis which can be hourly or flat.

An example of an advanced fee is when a client gives you $5,000 when they retain your services to assist with a criminal defense matter. The $5,000 will be earned for each hour you spend on the matter and when you incur time, you draw on the advanced fee.

Think of an advanced fee as a security deposit to ensure you are paid for your services.

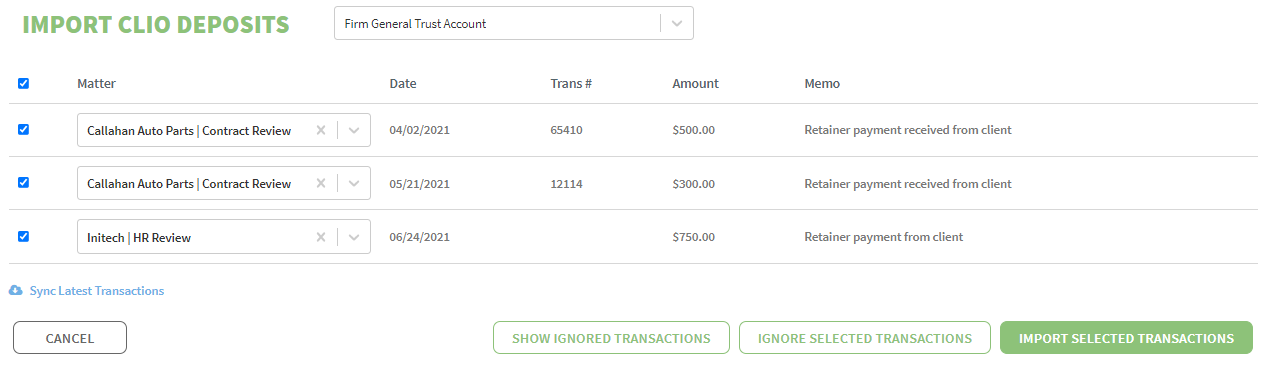

All advanced fees must be deposited into the trust account since the money belongs to the client until you earn it.

2. Flat Fee

A flat fee is a fixed amount paid to you for specific agreed-upon services regardless of the time needed to complete the services.

For example, if you charge a client $2,000 to prepare and file their divorce petition, this would be a flat fee. Regardless if it takes you 10 hours or 50 hours, you will only be paid $2,000.

A flat fee is not an advance against your hourly rate and should not be billed against an hourly rate.

A flat fee can be paid in advance, but it’s not earned until the work is completed. If paid in advance, the flat fee must be deposited into the trust account until it’s earned.

Another scenario of flat fees are nonrefundable fees or earned-upon-receipt fees that are paid in advance. These are considered earned upon payment because the attorney has stipulated in their agreement with the client that the fee is earned when paid and not dependent on the amount of future work to be performed. These fees do not need to be deposited into the trust account.

3. Retainers

In Arizona, you can receive a retainer to ensure your availability to complete services on behalf of a client and to preclude you from taking adverse representation. The retainer isn’t an advance payment for past or future services and can’t be billed against for fees or costs. The retainer is used to secure your representation, even if that means you must decline new clients.

The retainer becomes your property upon receipt and should not be deposited into the trust account.

To avoid confusion with a client, best practices would clearly define in a written fee agreement whose money it is, where it will be deposited, and how and when it will be used.

4. Advanced Costs

Similar to advanced fees, if you receive a payment to cover future costs for things like filing fees or costs to hire a private investigator, these are deemed advanced costs and must be placed in the trust account until incurred.

5. Contingent Fees

You can work on matters where your fee is contingent upon the outcome of the matter. These contingent fee agreements must be in writing and signed by the client. The agreement must state:

- The method by which the fee is determined including the percentage you receive if a settlement, trial, or appeal is negotiated or needed and

- Whether expenses will be deducted from any recovery before or after the attorney’s fee is calculated.

At the conclusion of the matter, you’ll need to provide a written statement to the client stating:

- The outcome of the matter,

- The remittance to the client (if any), and

- The method of determining the remittance amount.

This written statement is no substitution for a client ledger you should maintain for each client.

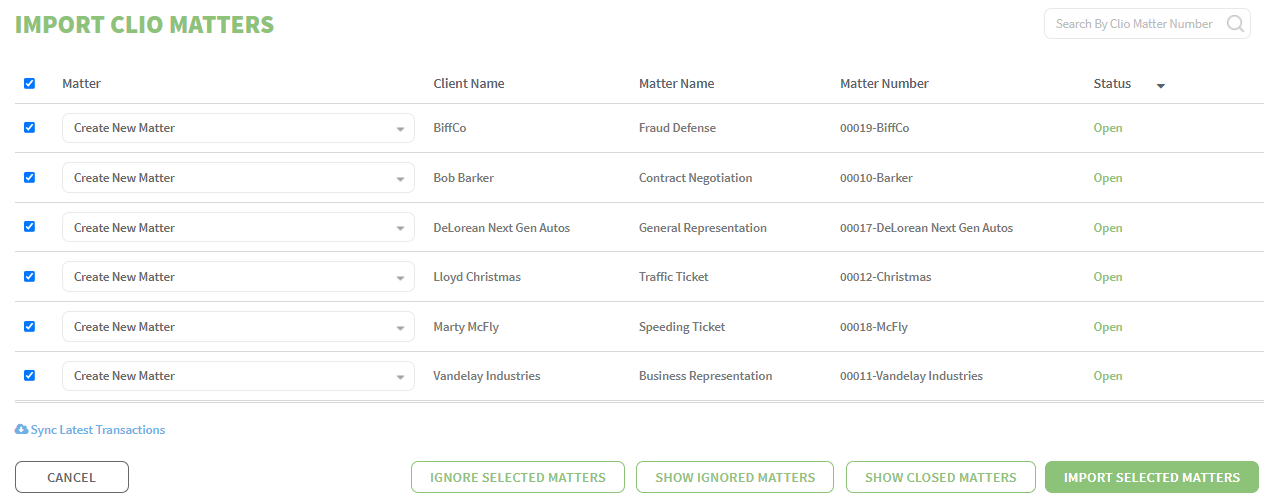

Keeping your trust accounting on track is easy with TrustBooks. See how recording fees into your trust and client account is simple by scheduling your free demo now.

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. For more detailed information, we recommend reviewing the Client Trust Accounting for Arizona Attorneys manual prepared by State Bar of Arizona.