My Real-Life Nightmare Using QuickBooks for My Trust Account

Having trouble managing your firm’s accounting needs using QuickBooks? Are you using a 15-step work-around process to properly track and report your trust account? You’re not alone because QuickBooks wasn’t designed for law firms.

Not too long ago, I owned a CPA firm that completed bookkeeping services for small law firms. I had worked with law firms before, so I was familiar with the accounting nuances of the industry.

We used QuickBooks accounting software because we were all seasoned QuickBooks users. Although not perfect, it was “good enough.” I could record expenses and generate invoices. Calculating payroll and filing tax returns was straightforward. But maintaining accurate trust accounts…this is where QuickBooks failed me.

One ordinary day, a client called and needed a trust account check issued immediately. This happens often and is not a big deal. I looked in the client’s file and panic quickly fills me. I can’t believe what I see. Five of the client’s ledgers are in the red! I close the file and re-open it, convinced that the file is being glitchy (something QuickBooks is prone to). Nope, the five ledgers are still negative. How could this be? How could me and my staff allow not one or two, but FIVE client ledgers be overdrawn? Houston, we have a problem!

After a few Hail Mary’s, I composed myself and began digging, determined to find the errors. After what seemed like 100 years but was only a few hours, I found the errors.

The root of the problem lies in the need to use a complex multi-step work-around process to accurately record client ledgers. To save ourselves time, we used a feature in QuickBooks that enters recurring transactions automatically. However, there is a problem with this process. These automatic transactions can only post to one client account. For example, assume you have 20 client ledgers and the automatic transaction is set up to post to client #1. But you need this automatic transaction to post 12 times to 12 different client ledgers. QuickBooks would post the transaction 12 times to client #1’s ledger making it overdrawn. And the other 11 client ledgers are incorrect too.

What was once seen as a time-saver, was now a huge time-waster.

Fortunately, we kept a spreadsheet for each client ledger that tracks all cash in and cash out. This spreadsheet was our savior. With the spreadsheet, I was able to correct all the automated entries to proper the client ledgers. At the end of the day, none of the client ledgers were overdrawn. Unfortunately, it took 12 hours and I’m certain I shaved a few days off my life thanks to the panic I felt when I saw all those negative balances.

I ran a CPA firm with trained accountants and QuickBooks’ experts, and we still made a mistake that took four hours to identify and eight hours to fix. Luckily, this was all caught internally and not during a State Bar audit. If that client had called that day to ask for the most recent reports of his trust account because the State Bar auditor was sitting in his office, it would have been one ugly scene. I guarantee you that I would have been fired (rightfully so), and my client would have been in the hot seat with the State Bar.

QuickBooks has inherent limitations to properly track an attorney’s trust account. To use QuickBooks, you need to have additional processes in place to reduce the risk of human error and to stay compliant with State Bar requirements.

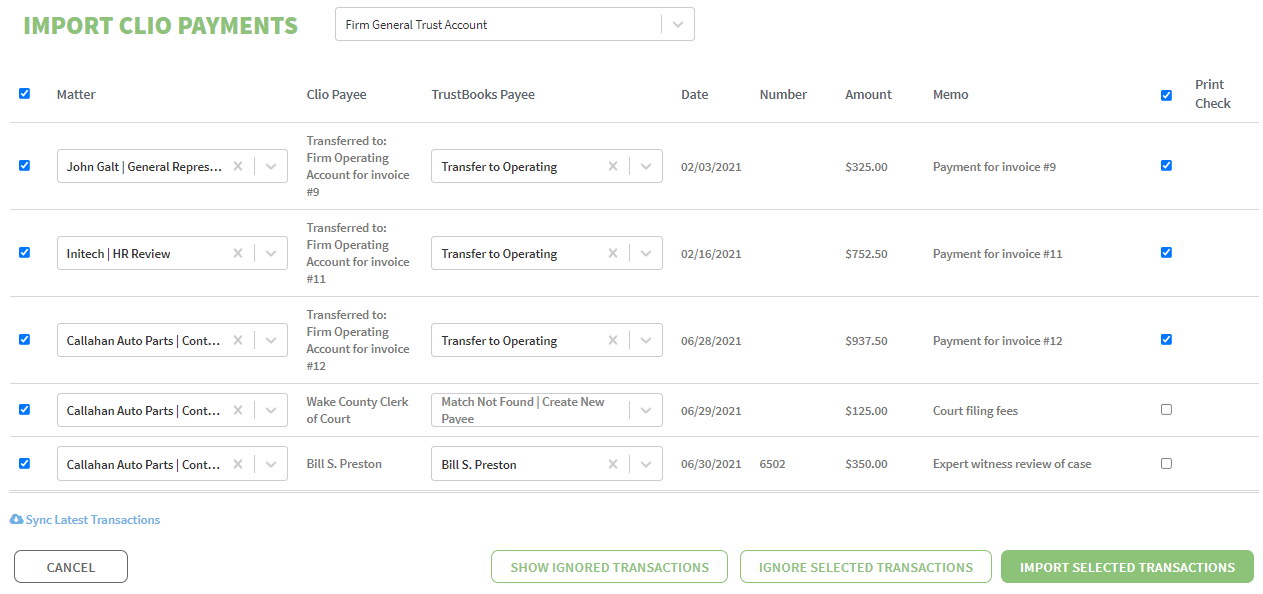

TrustBooks is designed to keep you compliant and it’s easy to use. No need to hire additional staff. To see how TrustBooks can simplify your trust accounting, schedule a 1-on-1 demo today!