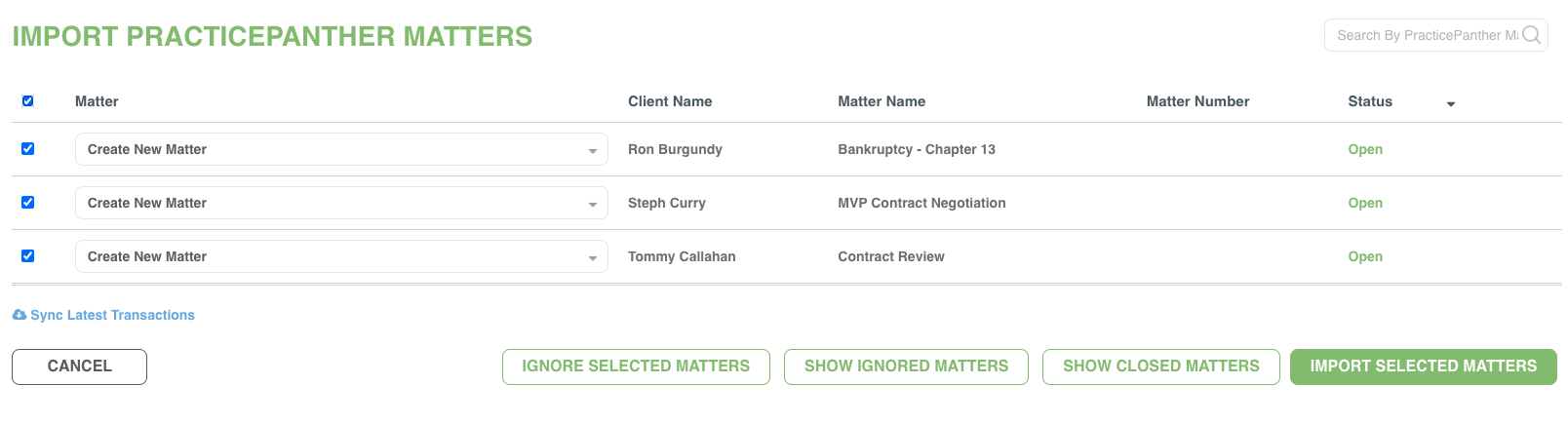

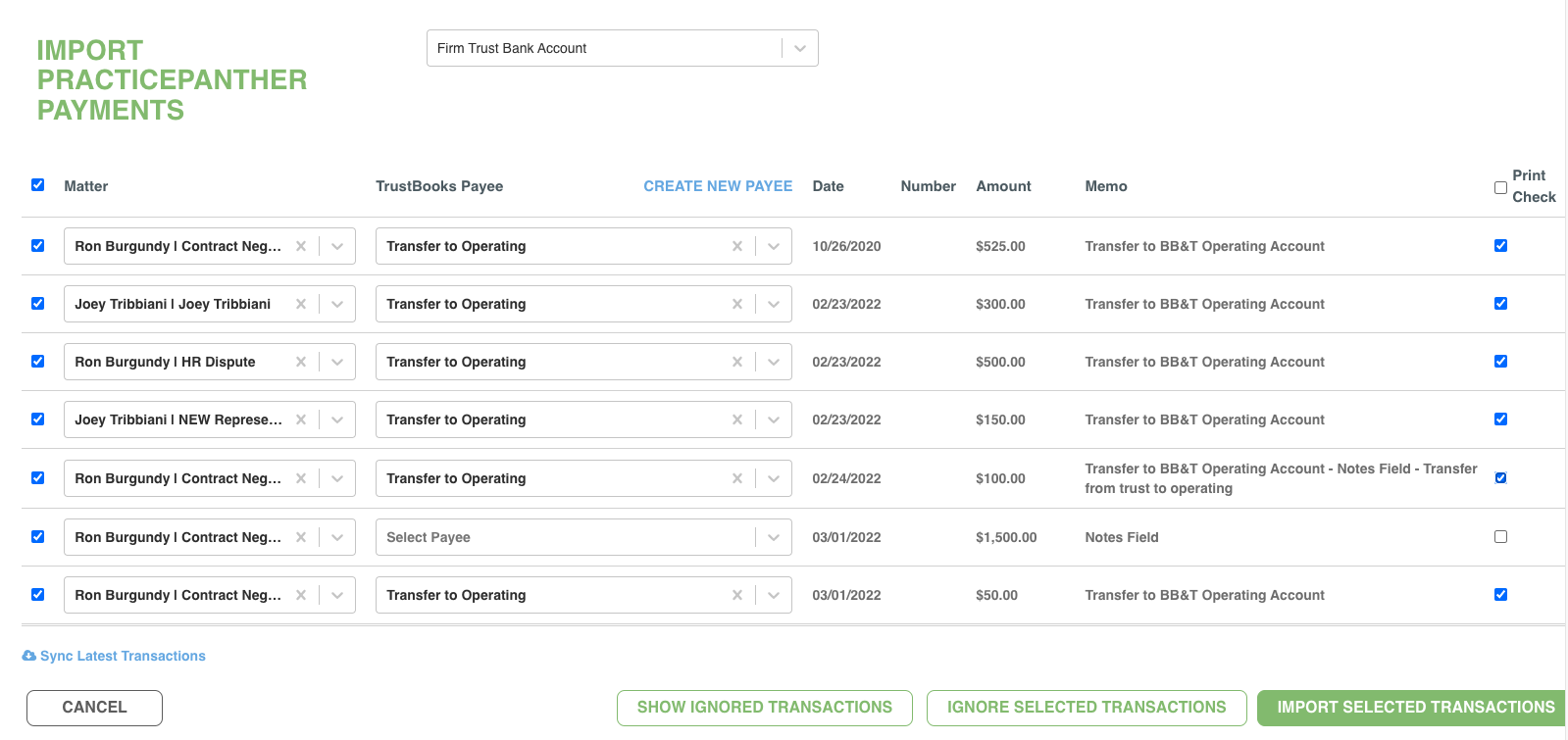

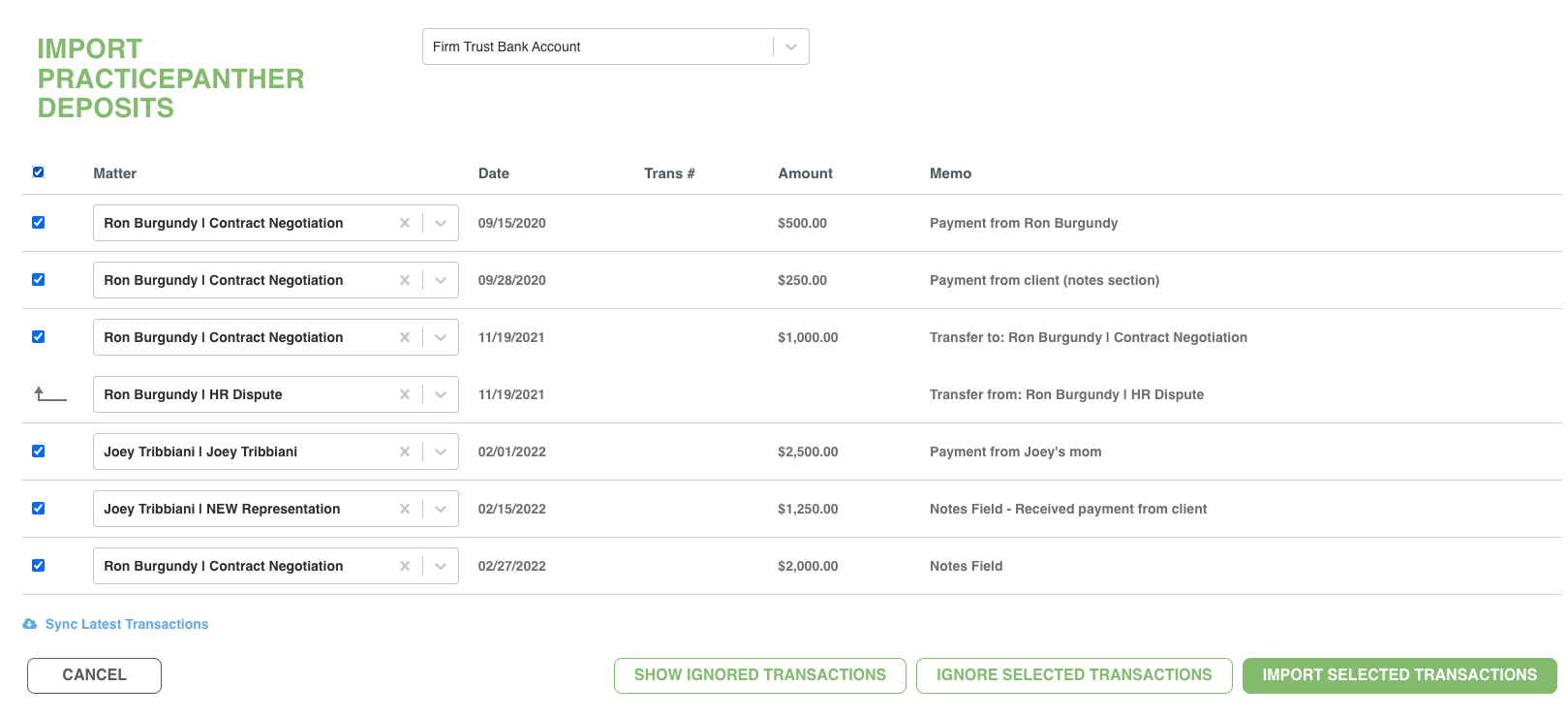

We recently announced that we joined the Paradigm family — a growing legal technology company home to several industry-leading law practice management platforms, including the all-in-one solution, PracticePanther. This was a huge milestone for TrustBooks and in light...

FREE E-book: A Complete Guide to Trust Accounts

TrustBooks partnered with LawPay to put together this step-by-step guide to help attorneys understand how to properly manage their trust accounts with the use of new technologies.

Integration Partners

TrustBooks integrates with the leaders in legal tech to provide an easy and complete solution to running your law practice.

Ready to see how TrustBooks can solve your firm's accounting headaches?

Trust Accounting Resources for Specific States

TrustBooks compiled state-specific resource pages to help you navigate the trust accounting rules for your state.

Legal Accounting Articles

We Have Exciting News To Share!

Since 2015, the TrustBooks team has worked tirelessly to make the lives of attorneys easier by providing them with accounting software tailor-made for law firms. We’ve had an incredible opportunity to learn from, and grow with, our customers over the years —...

5 Tips to Protect Your Trust Account

You have a responsibility to your clients and your state bar to keep your trust accounting accurate and free from misuse.

Avoid this QuickBooks Pitfall

Are you using a 15-step work-around process to properly track and report your trust account? You’re not alone because QuickBooks wasn’t designed for law firms.

Guide to NC Quarterly Review

Every state bar association requires that an attorney reconcile their trust bank statement to their clients’ individual balances either monthly or quarterly.

5 Easy Steps of Trust Reconciliation

To help you determine whether your trust accounting is accurate and error-free, we’ve broken out the trust reconciliation process into five easy steps.

The Risks of Putting Your Trust in QuickBooks

QuickBooks is not tailored to meet the unique and complex regulations of trust accounting, and so using the software to manage your trust account comes with inherent risks and complications.

The Essential Trust Accounting Guide

A brief and necessary overview of the essential trust accounting rules and regulations.

Starting Your Own Law Firm: Checklist

Launching your own firm? View the most important tasks for starting your own practice.

5 Key Factors in Improving Your Trust Account Management

Whether you’re just starting a practice or you’ve been running a firm for decades, the act of receiving and holding funds for clients is always an immense responsibility.

Case Study: This Iowa Law Firm Saves Hours Each Month With Month-End Reconciliations While Gaining Peace of Mind

Case Study: One Law Firm’s Experience Going Through State Bar Trust Audits with QuickBooks and TrustBooks

Case Study: How Watkins Law Firm Embraced Technology to Help with Their Trust Accounting