As the end of every month rolls around, you should be taking some time out to complete a trust reconciliation. One of the most important reports in trust account management, a two-way trust reconciliation compares your internal trust accounting records to the activity in your trust bank account, allowing you to confirm that your records are accurate, complete, and free from intentional or unintentional misappropriation.

The ultimate goal of the trust reconciliation process is to match, or clear, the transactions in your trust accounting records by comparing them to the transactions listed on your bank statement, which provides an independent accounting of the activity that flows into and out of your bank account. In a healthy trust account, the two records should be in perfect sync.

To help you determine whether your trust accounting is accurate and error-free, we’ve broken out the trust reconciliation process into five easy steps:

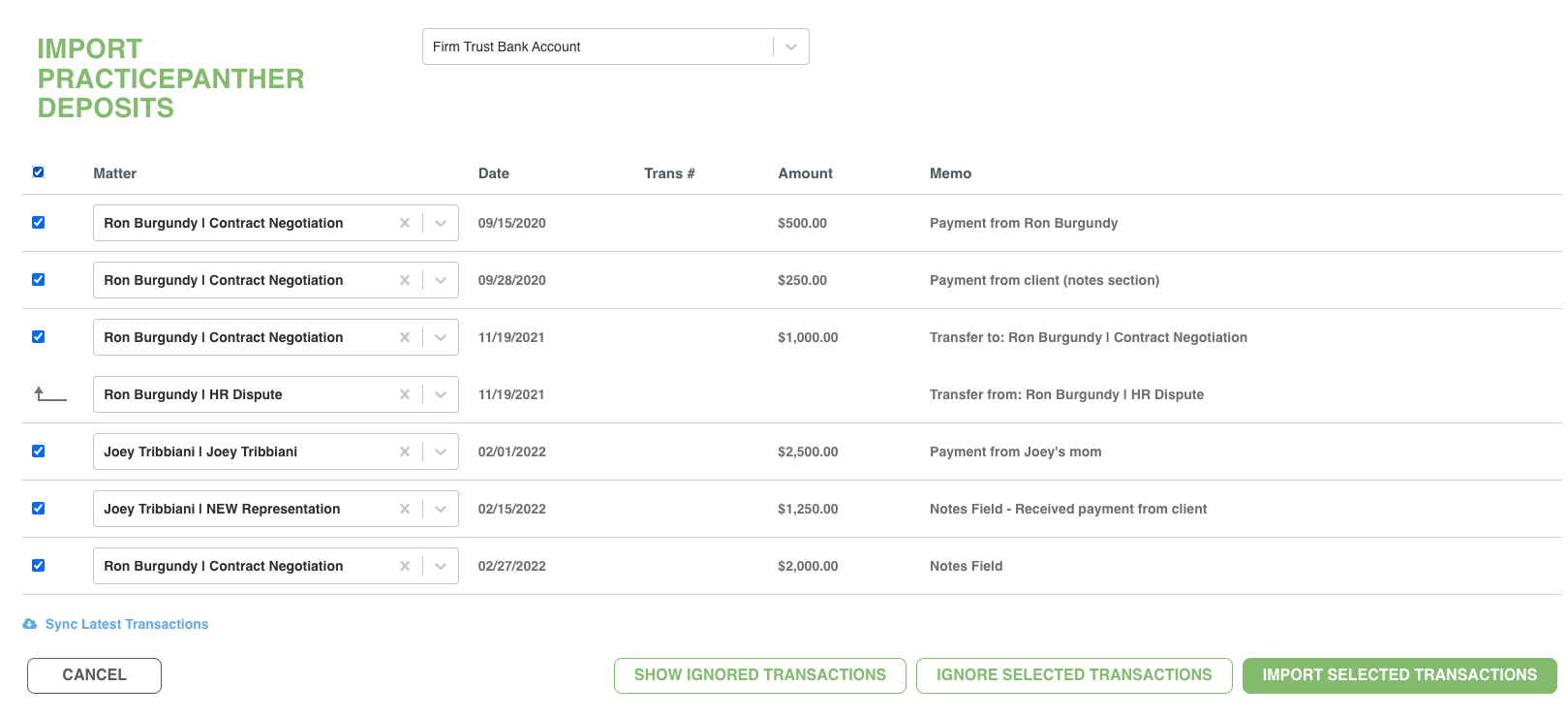

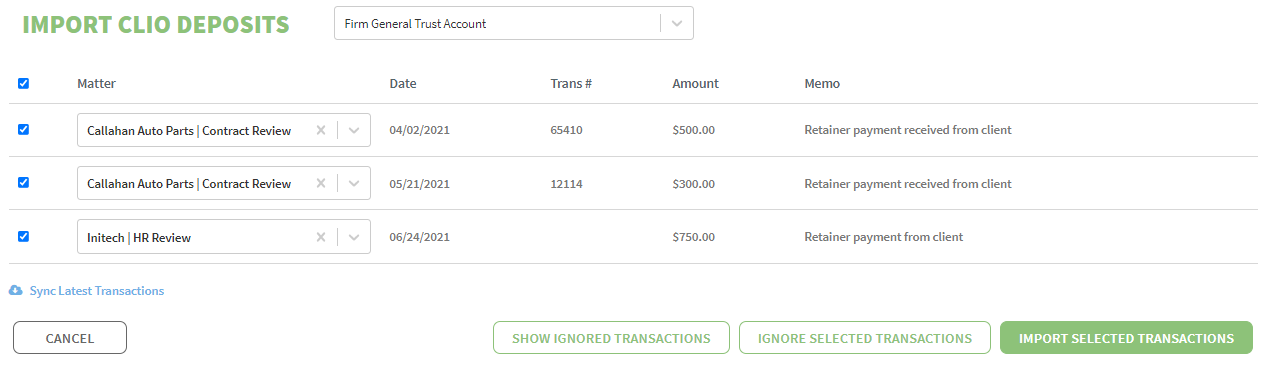

Step 1: Make sure your deposit records are complete.

Start with the cash inflows, or deposits, listed on your bank statement and compare them to the deposits in your trust accounting records. Ideally, each transaction on the bank statement will match a deposit entry in your trust accounting records, and you can mark these as cleared. If you come across a transaction on your bank statement that does not match any of the deposit entries in your files, that means your trust accounting records are incomplete. You’ll need to add the missing entry to your records, but you’ll also need to examine your accounting processes to see how it could have been overlooked in the first place. Remember, the goal is to have your trust accounting records reflect every transaction that flows through the bank account, so you need to address any issues as soon as they arise.

Step 2: Locate any uncleared deposit transactions.

It’s possible to have transactions that are recorded in your trust accounting records but that have yet to clear the bank account at month-end. Banks need time—around 1 – 3 business days—to process deposits, and so uncleared transactions typically occur when deposits are made on the very last days of the month. While these uncleared deposits should show up on the next month’s bank statement, you will still need to account for them in your month-end reconciliation, so be sure to make a note of them for reference later on. If you see a deposit transaction that continually shows up as uncleared from month to month, it’s likely that an error was made with the deposit transaction and an adjustment is necessary.

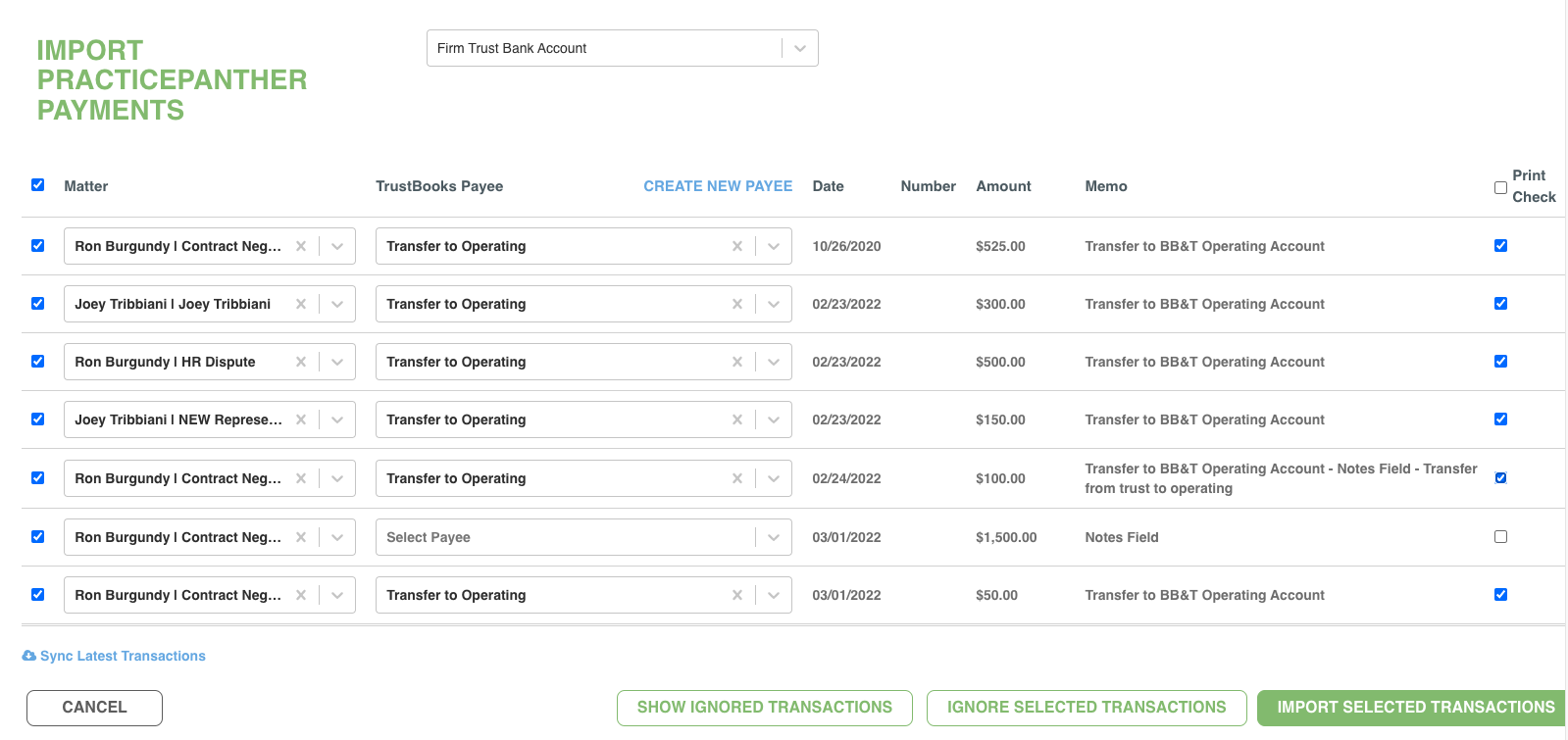

Step 3: Confirm your disbursement records.

Now that you’ve cleared your deposit records, you’ll need to perform the same process for cash outflows, or disbursements, as well. Compare the cleared checks and withdrawal transactions listed on the bank statement to the disbursements recorded in your trust accounting records. As with the deposits, most withdrawals listed on the bank statement should match the disbursement entries noted in your trust accounting records and these you can mark as cleared. If a withdrawal listed on the bank statement does not match any disbursement entries in your records, you’ll need to updated your files to address the error.

Step 4: Identify uncleared disbursement transactions.

With disbursements, it’s quite common to have transactions recorded in your trust accounting records that have not yet cleared the bank. For example, you may write and mail a check for an insurance settlement, but then the payee loses the check or changes their address or simply forgets to deposit it. All of these would cause a delay in the check being cashed, and if the check has not cleared the bank at month-end, it is considered an uncleared disbursement. Any outstanding checks will need to be carried forward from each trust reconciliation until the disbursement appears on the bank statement and the transaction can be cleared. Until then, outstanding disbursements will need to be accounted for in your monthly reconciliation.

Step 5: Account for uncleared transactions.

You’ve checked the deposits and withdrawals on the bank statement against your trust accounting records and you have isolated your list of uncleared transactions. The next step is to adjust the bank statement balance so that it accounts for the pending transactions you identified. To calculate your adjusted end balance, add any uncleared deposits and subtract any uncleared disbursements from the total given by the bank statement. This adjusted end balance should then match the month-end balance in your trust accounting records, making your trust account reconciliation a success. If the two balances don’t match up, you’ll need to go back and redo each step in the process, this time keeping a close eye out for mistakes.