In June 2016, a new trust requirement was issued in North Carolina that required a minimum of 3 transactions to be reviewed every quarter. In the Q2 2017 random audit results, 71% of the firms audited failed to meet this requirement. Law firms not performing the Quarterly Review has quickly taken over as the number one way to be out of compliance with the NC State Bar’s trust accounting rules and regulations. The NC State Bar is watching and you do not want to be caught out of compliance.

This compliance issue is caused by attorneys either not knowing the requirement exists or too confused on how to complete this newer requirement. The information below is a hands-on guide to give you a better understanding of the Quarterly Review and steps to complete it.

Overview of the Quarterly Review:

At the end of each quarter, a law firm is required to review a minimum of three transactions, chosen at random, that occurred during the quarter in their trust account. By taking a sample size of the trust activity during the quarter and reviewing these transactions, the NC State Bar extrapolates these findings to the rest of the trust activity during the quarter to ensure that the trust accounting rules and regulations are being followed. Another benefit to this Quarterly Review is the timely detection and hopeful prevention of any fraud or embezzlement of trust funds.

Steps to Completing the Quarterly Review:

Step 1: Select the quarter and trust account that you want to review. Next, select the transaction to review during the quarter. A transaction should represent an entire series of disbursements related to a single transaction. For example, if an attorney practices real estate, the sale of a home would be considered a single transaction. All the disbursements related to the sale of the home would need to be reviewed under this selected transaction.

Step 2: You will be required to review the following items for the selected transaction:

- Statement of Costs and Receipts (another name for your trust ledger)

- Client Ledger

- Copies of checks

Your review of the Statement of Costs and Receipts and Client Ledger should trace the disbursements directly into each of these reports. You will want to verify that the information from the checks exactly match the information recorded in the Statement of Costs and Receipts and the Client Ledger. You will also need to confirm that no violations of trust rules have taken place (for example – client ledger was not in the negative). For review of the checks, you will need to review the payee, signature, and endorsement. You are confirming that this information matches your accounting records and no fraud or embezzlement has occurred.

After this review, you are required to;

- Document how many disbursements were included in this transaction

- Document if any disbursements are still outstanding at quarter-end

- Document if any of the disbursements were improperly made.

This completes your review of the first transaction.

Step 3: You will need to repeat Step #2 for at least two more transactions. You have the option to review more than three transactions during the quarter, but the requirement states that, at a minimum, you must review three transactions each quarter.

Step 4: The final step will be to complete the Quarterly Review Report. Once you complete Step #2 for a minimum of three transactions, you will compile your review into a final package and keep for your records. In this package, you will include the following:

- Results of your review from Step #2. You will need to sign and date this form. The NC State Bar has provided a template that you can use to document your findings. View the Template

- Include images of the cancelled checks

- Include copies of the Statement of Costs and Receipts for the quarter

- Include copies of the Client Ledgers for the transactions selected

Best Practices

- The completion of the Quarterly Review should remain solely with the Attorney and not delegated to a staff member. One of the primary goals of the Quarterly Review is to detect fraud or embezzlement. If the person performing the accounting and reconciliations is also the person responsible for compiling the Quarterly Review, this person could completely circumvent any detection controls. To avoid losing oversight, the Quarterly Review must be completed by the attorney.

- The transactions selected should be skewed towards transactions with more volume or more complexity. The NC State Bar wants you to choose the transactions with the highest likelihood for error or fraud to occur. Ultimately, this will be a judgment call by the attorney, but this guideline should be used when selecting the transactions to review.

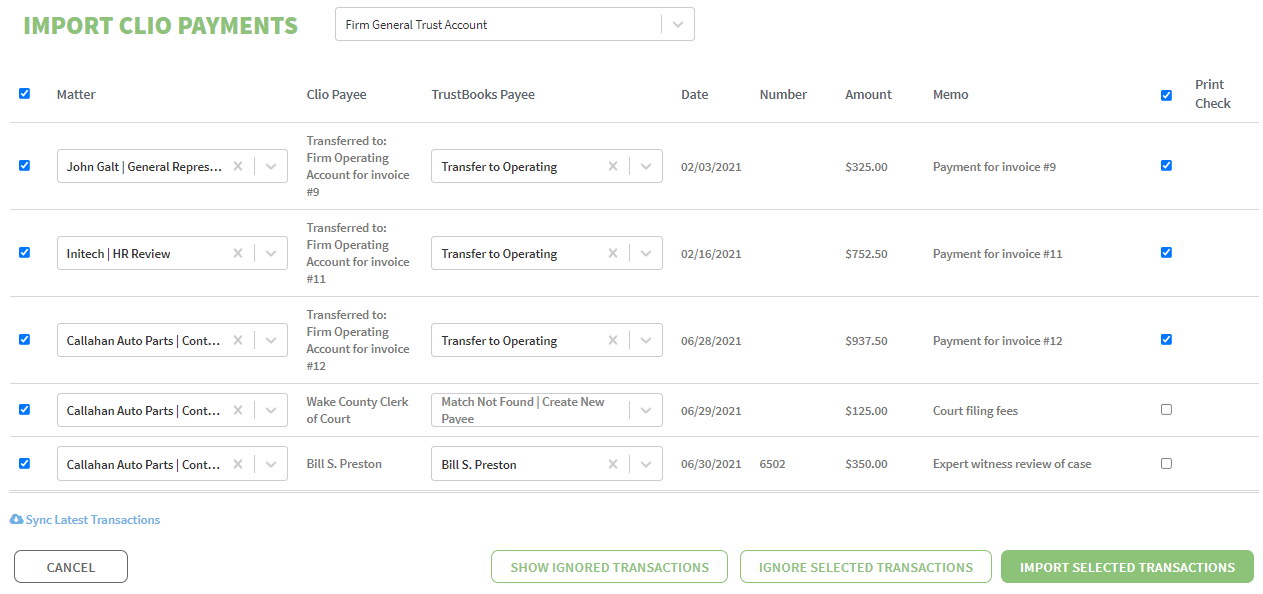

- Using a good software to help complete the Quarterly Review can help ensure that you are meeting each requirement of the Quarterly Review and save significant time on completion of the Quarterly Review. Using Excel, Quickbooks, or other non-trust accounting software will not help keep you protected during a Quarterly Review.

TrustBooks is the only software that allows you to complete the Quarterly Review and create a final document that is automatically saved in TrustBooks.

If you have any questions about how TrustBooks can protect your trust accounting, please reach out. We are here to help.