The California

Trust Accounting Guide

Gain a complete understanding of the State Bar of California trust rules. Insight into the rules and best practices to keep you compliant.

TrustBooks is proud to be recommended as an affinity partner with CalBar Connect and California Lawyers Association.

Want to find out more about our member benefit program, contact TrustBooks.

7 Key Concepts Every California Attorney Needs to Know for Trust Accounting

To know your trust accounting responsibilities, you will want a full understanding of the 7 key concepts for trust accounting as described in the Handbook on Client Trust Accounting for California Attorneys published by the State Bar of California.

Segregation of Client Funds

Do Not Bring Client Ledgers Into the Red

There’s No Such Thing as a Negative Balance

Timing is Everything

Timely Recordkeeping

Final Client Balance Should Always Be Zero

Always Maintain an Audit Trail

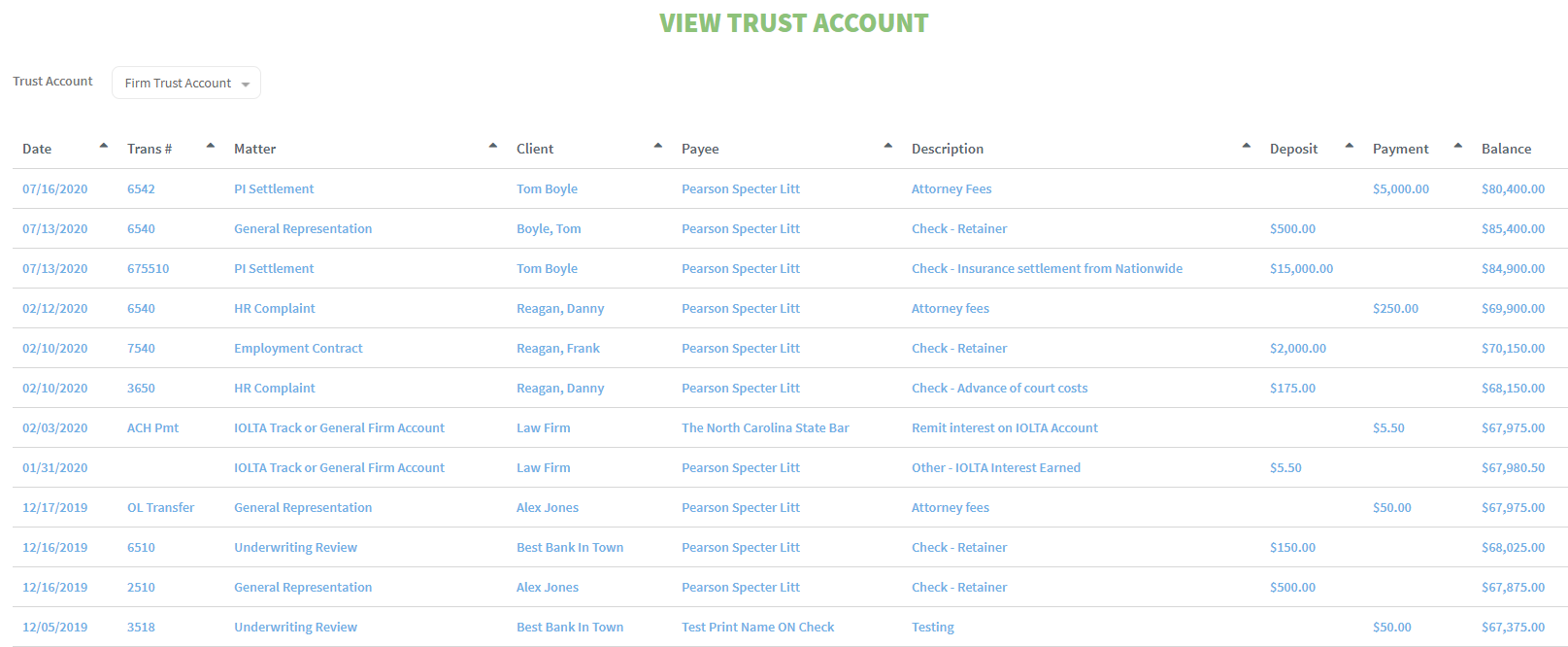

The 5 Trust Records Every California Attorney Must Maintain for Their Trust Account

Know the specific minimum reports that the State Bar of California requires you to maintain for your trust account.

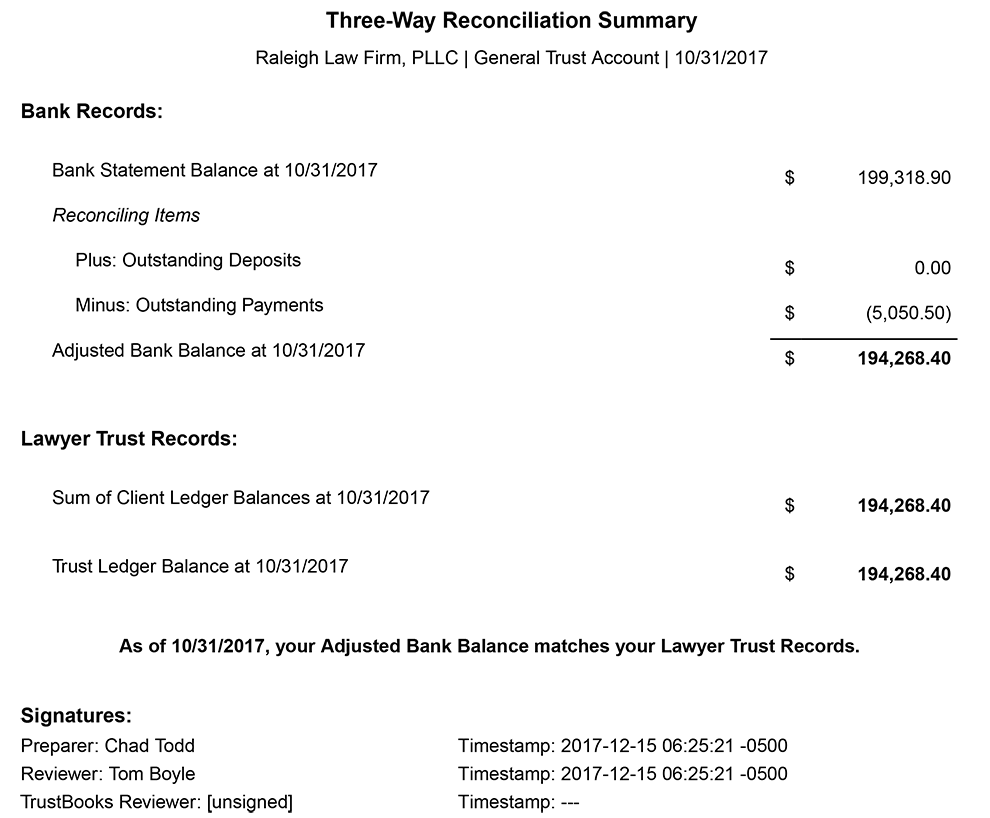

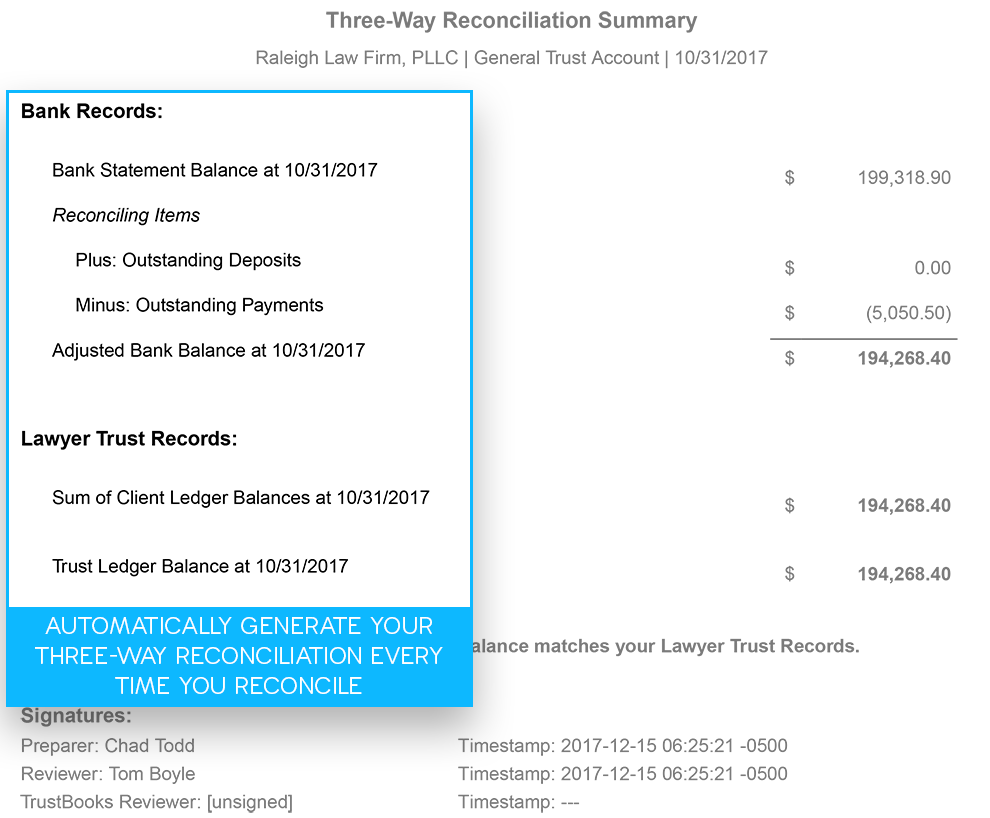

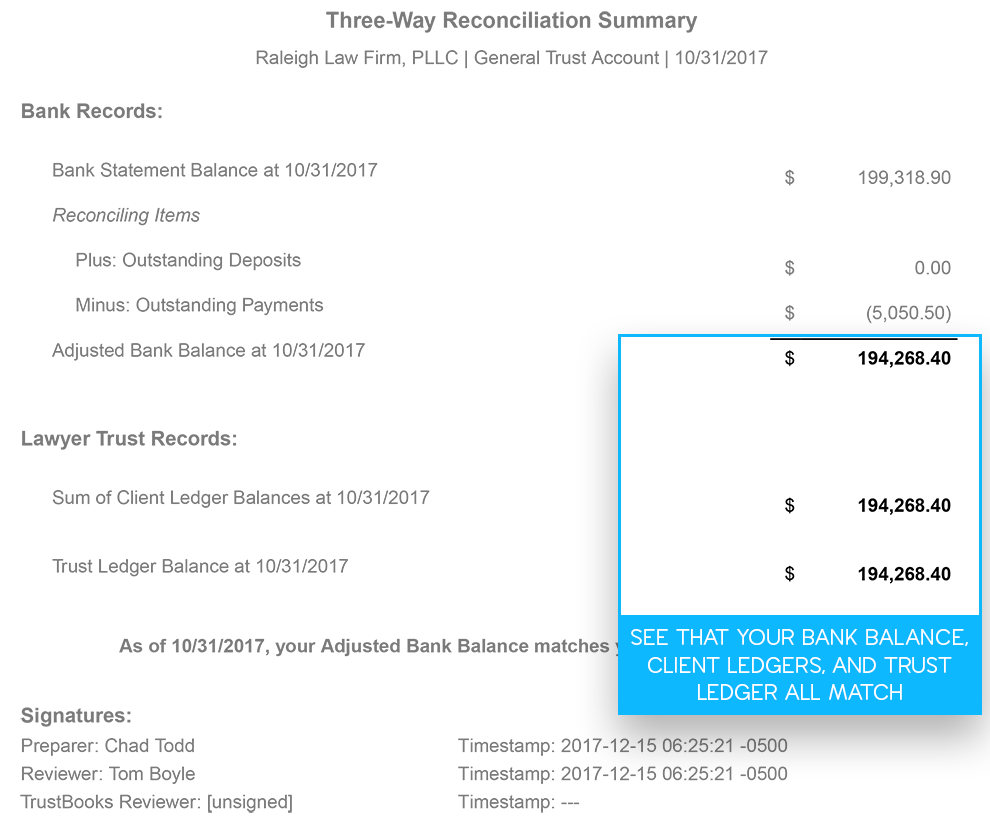

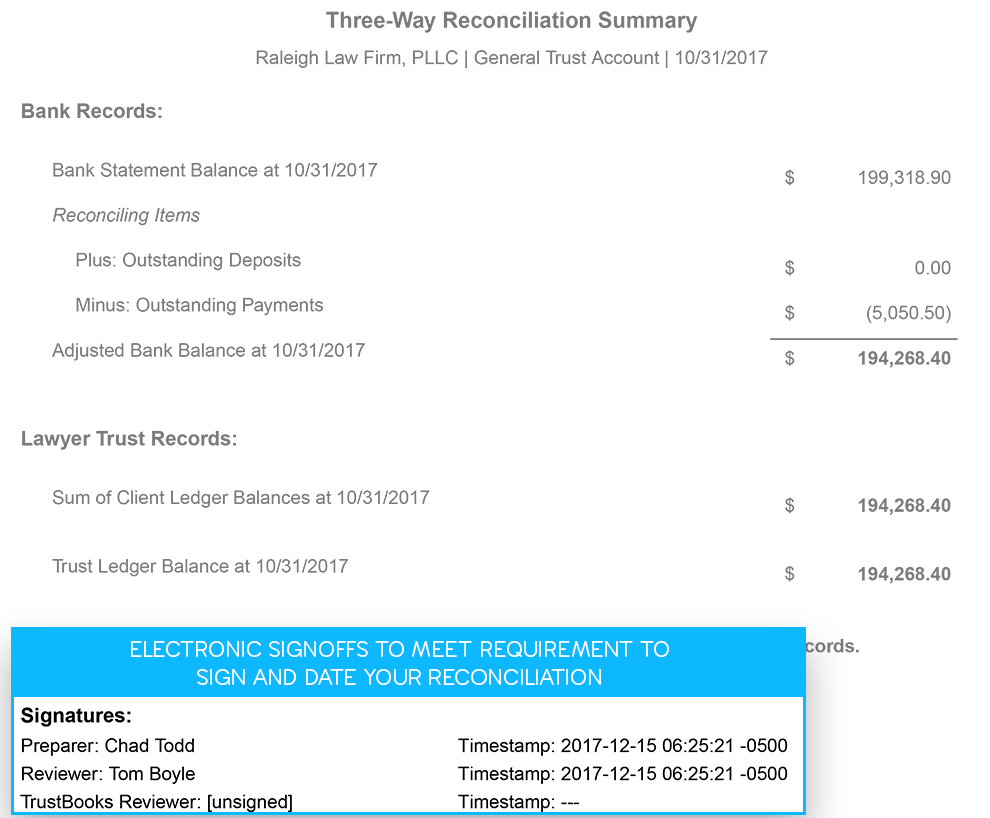

3-Way Trust Reconciliations

Every month, the State Bar of California requires you to complete a 3-way reconciliation. This report reconciles your bank balance to your trust ledger to the sum of your client ledgers.

Common Trust

Accounting Pitfalls

Want to know the common mistakes attorneys make with their trust account? Learn from your peers to avoid these common trust accounting issues.