Every California attorney that maintains a trust account has a responsibility to follow the trust rules safeguarding the funds they are holding for their clients. The attorney has a personal responsibility over these entrusted funds. You owe it to yourself to have a complete background on the trust rules in order to understand your client trust accounting responsibilities.

The first step to understanding the trust rules and your responsibility is to review the seven key concepts in client trust accounting. Below is a breakdown of each concept:

1. Segregate Client Funds

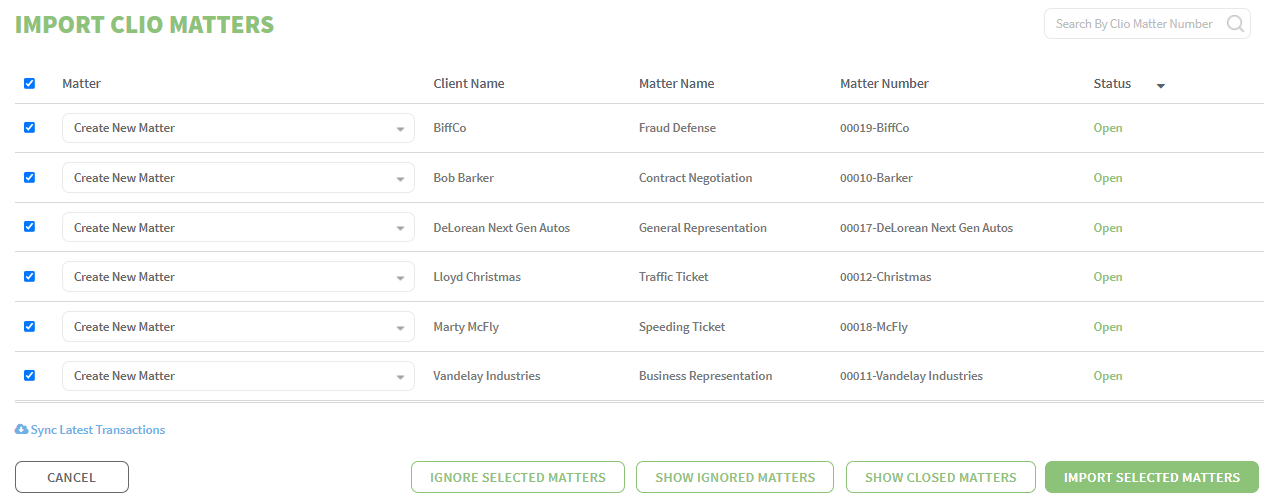

You can maintain one trust account for all your clients’ trust funds. However, you’ll need to maintain separate ledgers for each client since you’ll need to know exactly how much you’ve received from and paid out on behalf of each client.

Since Client A’s money has nothing to do with Client B’s money, keeping separate client ledgers will ensure that one client’s funds are not used to pay your or another client’s obligations.

By keeping each client’s ledger properly, you’ll know exactly how much money in your trust account belongs to each of your clients.

2. Don’t Bring Client Ledgers into the Red

For each client with funds in your trust account, you cannot disburse more money than what is available for each specific client. This is regardless of the total amount of available funds in the trust bank account.

For example, if Client A has $1,000 in her trust account, the most you could disburse for her would be $1,000. To spend anything greater than $1,000 for Client A would be borrowing against another client’s funds. This is a big no-no and could result in a State Bar finding of misappropriation.

3. There’s No Such Thing as a Negative Balance

Writing checks on your trust account that has insufficient funds to cover the check is also a big no-no. A client ledger and your trust account should never have a negative balance. In trust accounting, there are four possibilities:

- You have a positive balance (you’re holding money for a client),

- You have a zero balance (all the client’s money is paid out),

- You have a small amount in your trust account (to cover bank service fees), but no client funds, or

- You have a negative balance and a problem.

4. Timing is Everything

You’ll need to remember that not all deposits are created equally.

Depending on the type of deposit, it can take anywhere from a day to several weeks for a deposit to be available for use. And if you write a check for a client at any time before the deposit is posted to your trust account, you’ll either overdraw your account or use another client’s funds to cover the check.

When you open your trust account, get the bank’s deposit schedule. This will let you know the daily cut-off time for deposits to post on the same business day. This is crucial because even if you deposit cash after the cut-off time, the deposit won’t post and be available until the next business day.

Your bank might provide immediate credits to your account while it waits for the money from the other bank. This, in essence, creates a loan from the bank to you. Along with overdraft protection that your bank may offer, these immediate credits cause a commingling of trust and non-trust funds.

5. Keep Up on Recordkeeping

Recording each transaction in a timely manner will make it very difficult to spend more money than your client has.

Updating your client’s ledger at the same time you write a check or make a deposit is best. This way you’ll know exactly how much money your client has before spending their money.

6. Final Client Balance is Always Zero

What goes into your trust account for each client must be what goes out for each client. No more and no less.

If you have a balance for a client whose matter is closed, you’ll need to disburse the money. Sometimes a balance can be from a mathematical error or from a check you wrote that was never cashed. Whatever the reason, you’re responsible for the funds. If you find yourself with small balances and are unable to pay out the funds, you can consider if any unclaimed balances need to be escheated to the state.

7. Always Keep an Audit Trail

An audit trail is all the bank documents necessary to trace what happened to the money in your trust account. It starts when you receive the first deposit from a client and ends with the last disbursement.

Without an audit trail, you’ll have a tough time showing that you handled your clients’ trust funds appropriately.

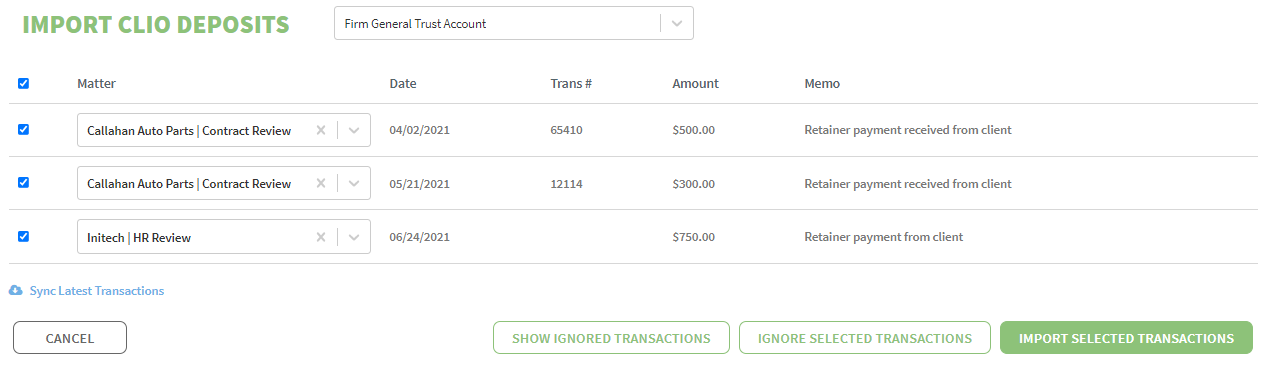

Be descriptive with all documents from your trust account. Every deposit and check should include the client’s name and if you have more than one matter for a client, you’ll also want to identify the matter. Being detailed now will help if any questions pop up.

Good audit trails include:

- Initial deposit slip showing the date, amount, client name, and bank’s date stamp showing date deposit was received,

- Bank statement showing when deposits posted to your account and when checks cleared your account,

- Check register showing when payments were made, how much, to whom, and the reason they were made,

- Canceled check images, and

- Copies of the front and back of all drafts/checks received on behalf of a client. This is especially important for insurance settlements.

Trust TrustBooks for your trust accounting needs. Schedule your free demo now to see how it keeps your client ledgers separate and how easy it is to do a 3-way reconciliation.

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. For more detailed information, we recommend reviewing the Client Trust Accounting for Arizona Attorneys manual prepared by State Bar of Arizona.