Trust accounts. If you’re like most attorneys, you have a love/hate relationship with them. You know you need to maintain them but dread doing so.

But not making your trust accounts a priority, you leave yourself vulnerable to errors or worse.

Make sure you’re treating your trust account with the care it deserves so you can avoid these common errors.

Required Trust Account Records

Make sure you have all the required records in hand before starting.

Each month you’ll need to complete a reconciliation for your trust account. To do this, you’ll need the bank statement and your trust ledger.

You’ll also need to reconcile your trust ledger to your client ledger. Your trust ledger’s ending balance should always equal the sum of all the ending balances of your client ledgers.

This multi-step reconciliation is called a 3-way reconciliation. In software specifically developed for attorneys, like TrustBooks, this 3-way reconciliation will automatically happen each time you reconcile your trust account.

Common Errors When Reconciling Trust Accounts

Since attorneys usually aren’t accountants, reconciling a trust account can be unenjoyable. But it’s a monthly necessity and you are fully responsible for the activity within your trust account. Delegating the ultimate responsibility isn’t an option.

Using a spreadsheet or accounting software not designed for attorneys makes the likelihood of an error more likely. Accurate trust accounting is vital to keep your firm compliant with State Bar of Texas rules. There’s no room for error.

What happens when you do find yourself in the unwanted scenario where your trust ledger doesn’t match the sum of all your client ledgers? These are the three most common errors.

1. Missing client ledgers

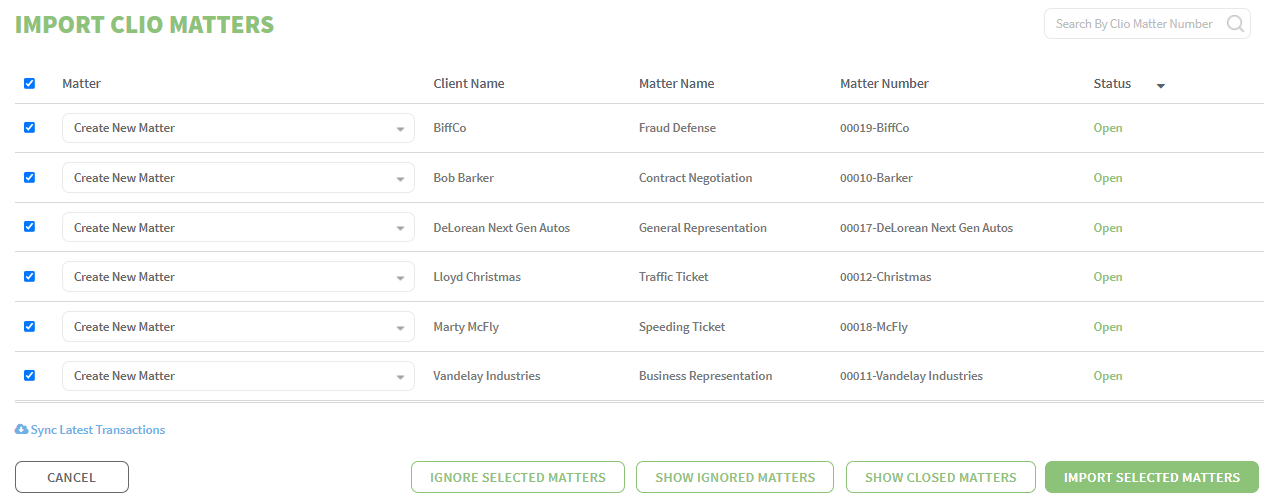

One of the fundamental tasks in maintaining good trust accounting records is maintaining a separate client ledger for each client’s trust activity. This should be the first place you look if your trust ledger and the sum of your client ledger balances is off. Did you create and maintain a client ledger for each client?

Let’s say you use an Excel spreadsheet to track your client ledgers and you’ve had a busy month with accepting dozens of new clients and you forgot to add one of the new clients who paid you an advance fee. It happens. But using accounting software designed for attorneys eliminates this oversight.

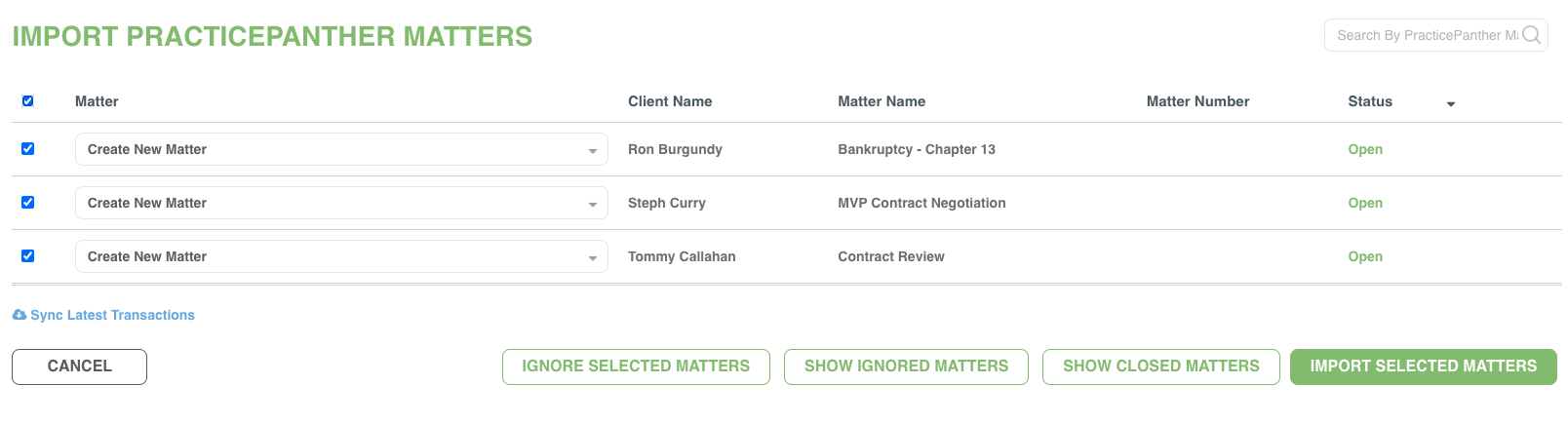

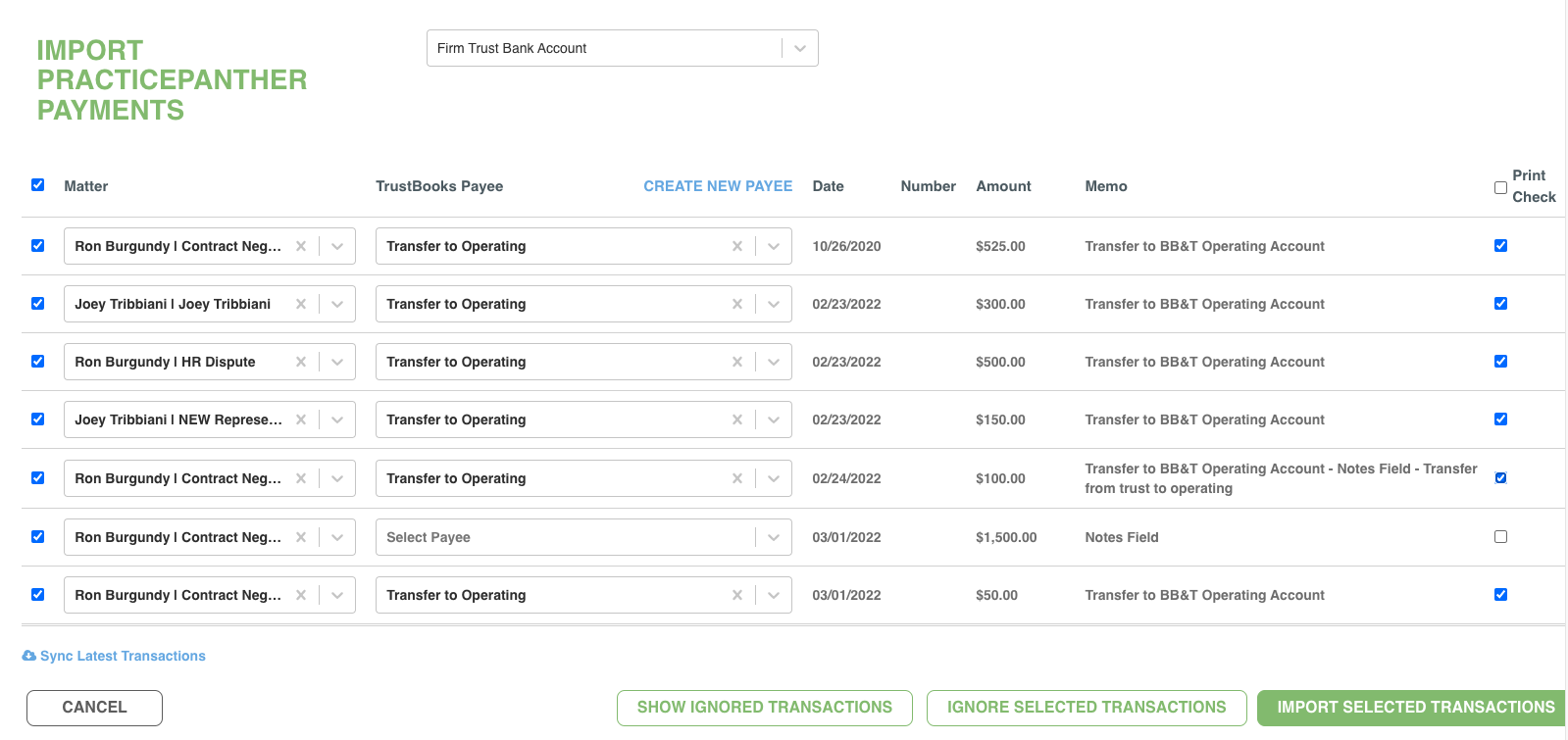

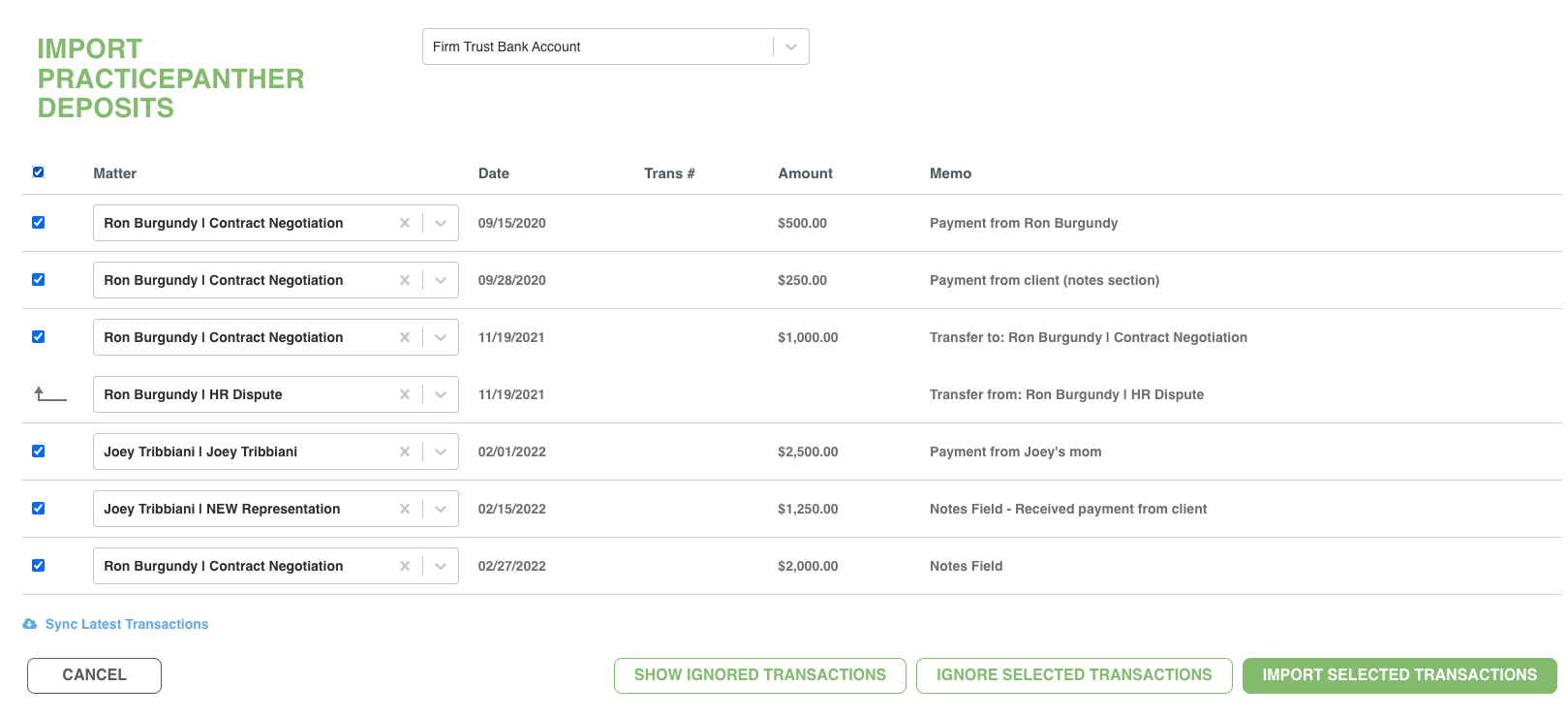

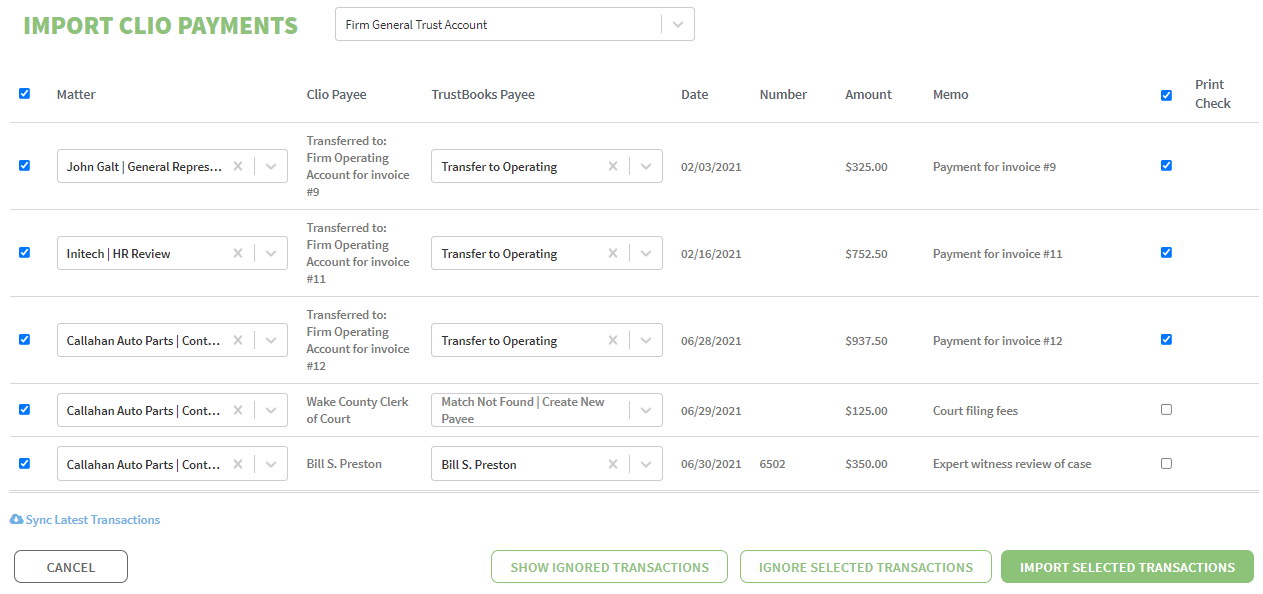

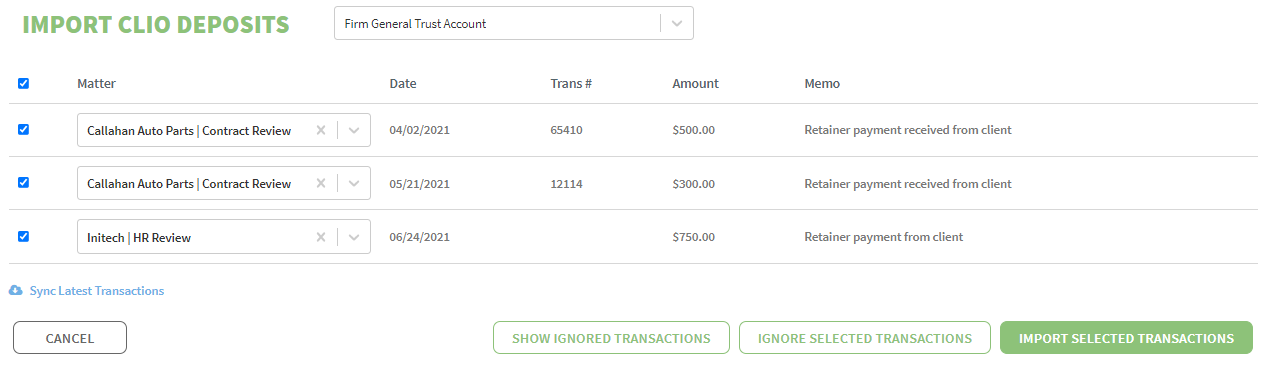

When deposits are made to your trust account, the software will require to you code the deposit to an existing client ledger or create a new client ledger. You won’t be able to move forward without properly coding the deposit to a client. This starts the process of maintaining client ledgers for each client.

2. Missing activity

Another common error is when a check or deposit is recorded in the trust ledger but not in a client ledger. Or vice versa, recorded in the client ledger but not the trust ledger.

This type of error happens more often with accounting systems not designed to meet the unique needs of attorneys. Accounting software and spreadsheets give you more freedom to enter activity any way you want. There is no rigid adherence to always maintaining a client ledger that matches your trust ledger. This can be a serious issue when it comes to your trust account.

3. Math error

Don’t let a number transposition or faulty addition derail your trust accounting. If you write a check for $1,789 but enter it as $1,798 in a client ledger, this $9 difference can cost you more than $9 after you invest your time trying to locate the difference.

This is most likely to happen when using a spreadsheet, or other manual system, to track your trust and client ledgers. And if you don’t pick up every cell in an excel spreadsheet formula or type a number wrong into your calculator, you will come up with the wrong number.

Don’t waste your valuable time tracking down math errors. Use an attorney specific accounting software to do the math for you.

Not only is it good law firm management protocol but regular trust account reconciliations are prudent and help to deter embezzlement when employees know you’re routinely reviewing your trust account.

Keeping current trust and client account balances will make answering your client’s question of “How much money do I have left” much easier. You’ll not be scrambling to do sloppy math calculations and you’ll be able to give your client some peace of mind that you’re running a professional business.

If your trust accounting isn’t up to speed and needs an overhaul, let us show you how TrustBooks can streamline the process, free up some of your time, and reduce your stress. Schedule your free demo today. It only takes 45 minutes and it’s free.

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. A Lawyer’s Guide to Client Trust Accounts created by the State Bar of Texas was the source of this information.