All California attorneys are governed by California’s Rule of Professional Conduct 1.15 – ‘Safekeeping Funds and Property of Clients and Other Persons.” This Rule provides a roadmap for properly handling of client trust accounts.

This rule covers many topics and one of the most important is Rule 1.15(d)(3) which discusses the five trust records you must maintain. You’ll also want to make sure you’re keeping your records secure.

Regularly reviewing this Rule and your trust records will help you to stay in the good graces of the State Bar of California.

1. Trust Ledger

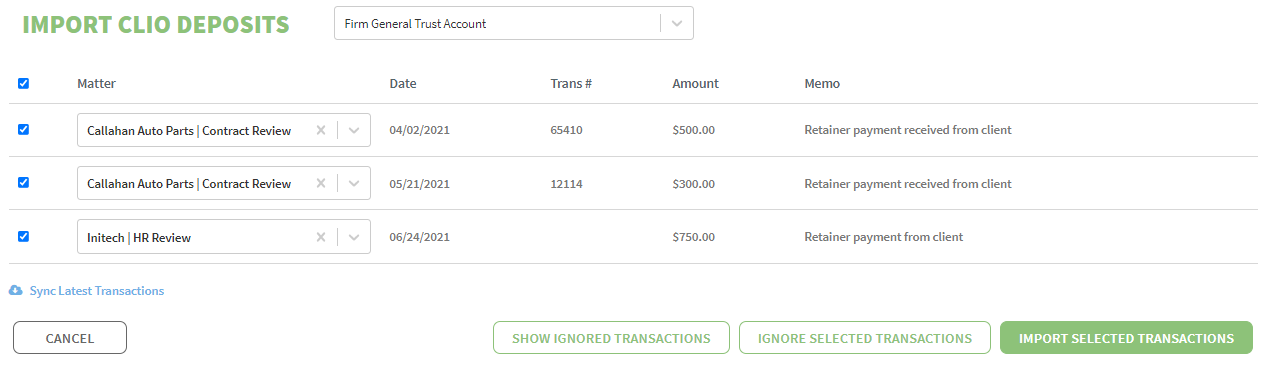

You’ll need to maintain a trust ledger for all money that belongs to your clients and it needs to include every transaction from the time you start your representation until it ends.

The trust ledger needs to include every deposit from and every disbursement made on behalf of a client.

In TrustBooks, you can see your trust ledger on the View Trust Account page.

Remember that a trust account must be a separate bank account from your firm’s operating account. Commingling of funds is strictly prohibited.

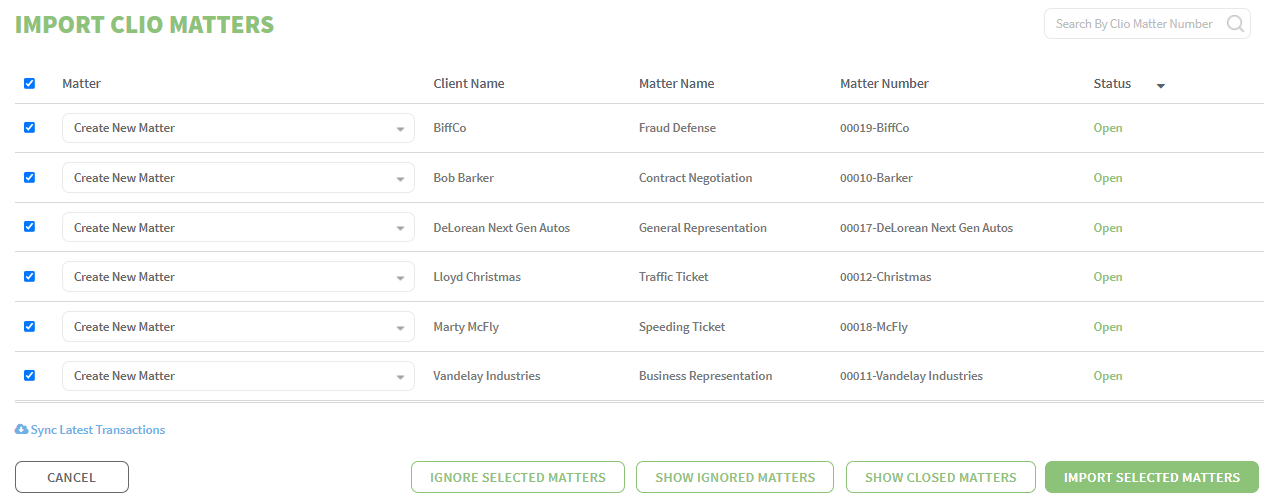

2. Client Ledger

Alongside the trust ledger, you’ll need to maintain ledgers for each client for whom you’re holding money. And you’ll need to keep the client ledger records for five years after you terminate representation.

The client ledger must include:

- The date, amount, and payor of each receipt of funds,

- The date, amount, and payee of each disbursement, and

- The ending balance.

TrustBooks provide an easy way to view your client ledgers. In TrustBooks, the client ledger is called the matters ledger because we recognize you may have several causes of action you’re working on for one client.

To see your matters ledger, click on the View Matters Ledger.

3. 3-Way Reconciliation

Each month, you’ll need to complete a three-way reconciliation between your trust ledger, your client ledgers, and the trust account bank statement.

The sum of the balances of all your client ledgers should equal the balance of your trust account and that balance should agree with the bank statement after accounting for any in-transit items. In-transit items include outstanding checks which haven’t been cashed and any deposits that haven’t been received and posted by the bank.

TrustBooks automates the three-way reconciliation. Each time you reconcile the trust account, a three-reconciliation is automatically generated. And you can see the three-way reconciliation in the View Reconciliations page.

4. Bank Statements

In addition to the records already discussed, you’ll need to keep some other information you receive from your bank or give to your clients.

Be sure to hang on to:

- All trust account bank statements,

- Copies of all canceled checks or evidence of other disbursements like wire transfers,

- Copies of all deposit slips, and

- Reports to clients.

If your bank provides electronic copies of bank statements or canceled checks, that is ok so long as you will have access to them for the five years after your representation ends.

You’ll be able to upload and attach bank statements to your trust ledger in TrustBooks for extra recordkeeping protection.

5. Non-Cash Property Ledgers

If you hold non-cash property on behalf of clients, you’ll need to keep record of it.

You’ll need to include the date received, where it is located, and when it was returned or distributed.

The non-cash property ledgers can be kept electronically via a spreadsheet or database. You could also keep a manual ledger; although that’s not recommended since there is no backup copy and it can be more difficult to safeguard.

TrustBooks makes trust accounting easy. Schedule your free demo today so you can see how your firm can simplify and streamline your trust accounting.

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. For more detailed information, we recommend reviewing the Client Trust Accounting for Arizona Attorneys manual prepared by State Bar of Arizona.