Law school taught you the letter of the law. But it didn’t teach you how to be a practicing attorney. One of the most sacred ethical responsibilities you have is to safeguard any funds you receive that belong to your client or a third party.

If your practice involves accepting money from clients before work is completed or receiving settlement funds, you’ll need a trust account. Understanding the types of fees you’ll receive is critical in determining how you’ll account for it.

You’ll first need to determine who the money belongs to at the time you receive it and then determine if the money is refundable or non-refundable.

Types of Funds Belonging in Trust Account

The funds that must be deposited into a trust account are:

- Advance fees and most retainers received from clients until they are earned

- Money that belongs to both the client and the attorney

- Funds held for a client to be disbursed at a later date

- Funds held for a third party to be disbursed at a later date

Examples of these types of funds include:

- Advance fee or advance costs

- Settlement money

- Retainers that will be drawn down at an hourly rate

Examples of funds that shouldn’t be in a trust account are:

- Fully earned fees

- Reimbursement for cost advances

- Attorney’s personal or business transactions

Different Types of Fees Texas Attorneys Earn

Unearned Fee

An unearned fee can take many names. It can be called a flat fee, advanced fee, or contingent fee. Regardless of the name, if you haven’t completed work to earn the fee, it must be held in your trust account.

For a flat fee, ensure your client agreement spells out how the fee will be earned. It could be by milestone or at specific dates. And until you complete the agreed upon service, the funds should be kept in your trust account.

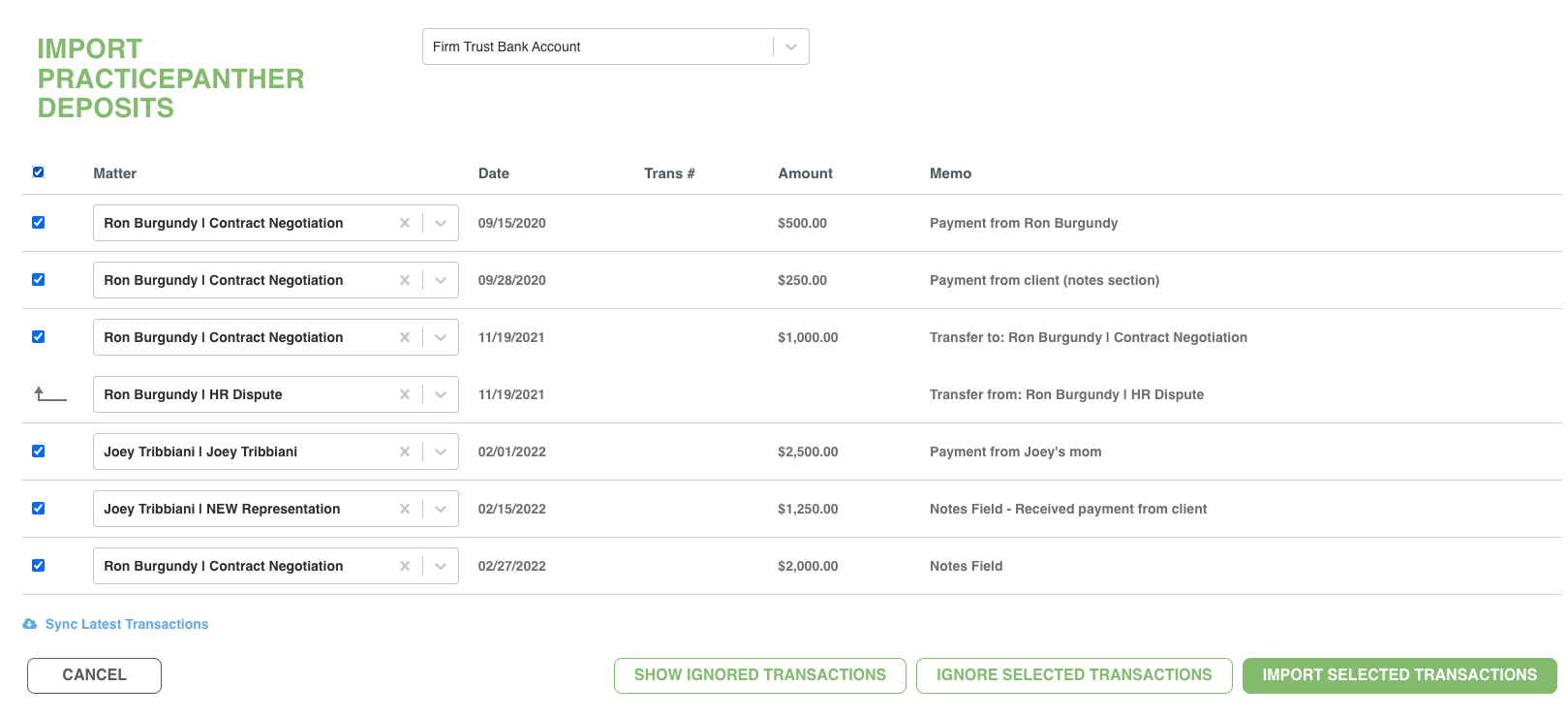

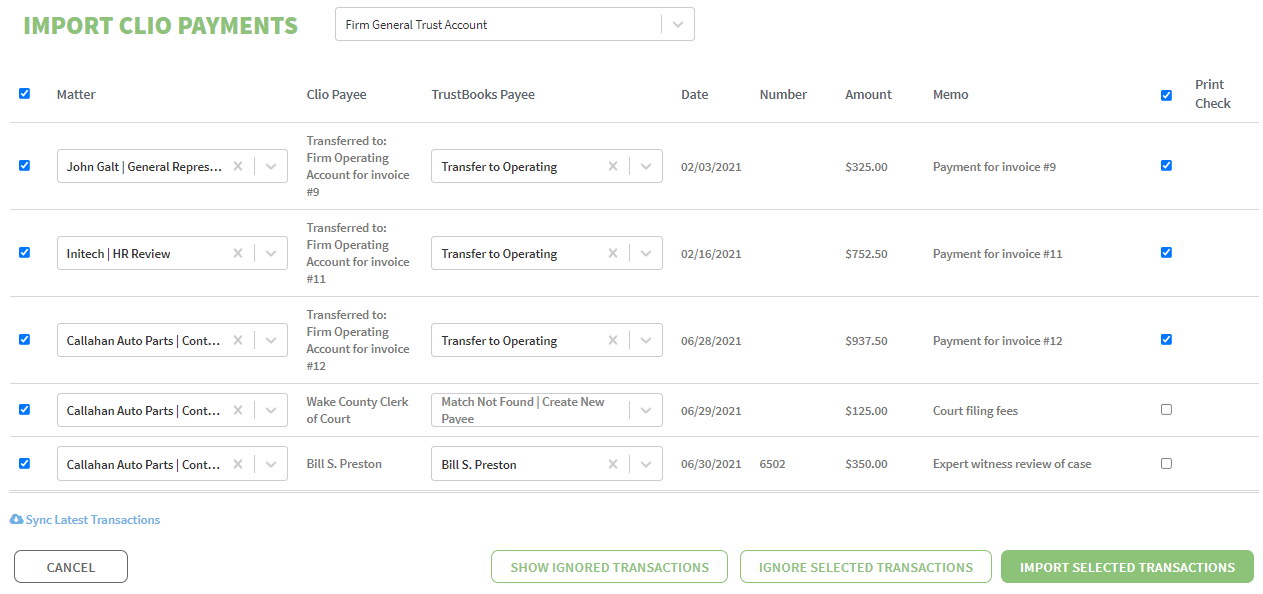

If you take on cases based upon a contingent fee agreement, any settlement funds you receive must be kept in the trust account and you must notify your client immediately of the receipt. When you’re ready to make disbursement of the settlement funds, you must provide your client with a written accounting of how the funds were dispensed.

True Retainers

Receipt of a true retainer is not a payment for services. It is a nonrefundable fee to secure your service and to compensate you for the loss of opportunity to take on new client work. It becomes the property of the attorney and should not be deposited into the trust account. Again, be sure your client agreement spells out the details of what the retainer is for and who the money belongs to.

Advance Payment for Expenses

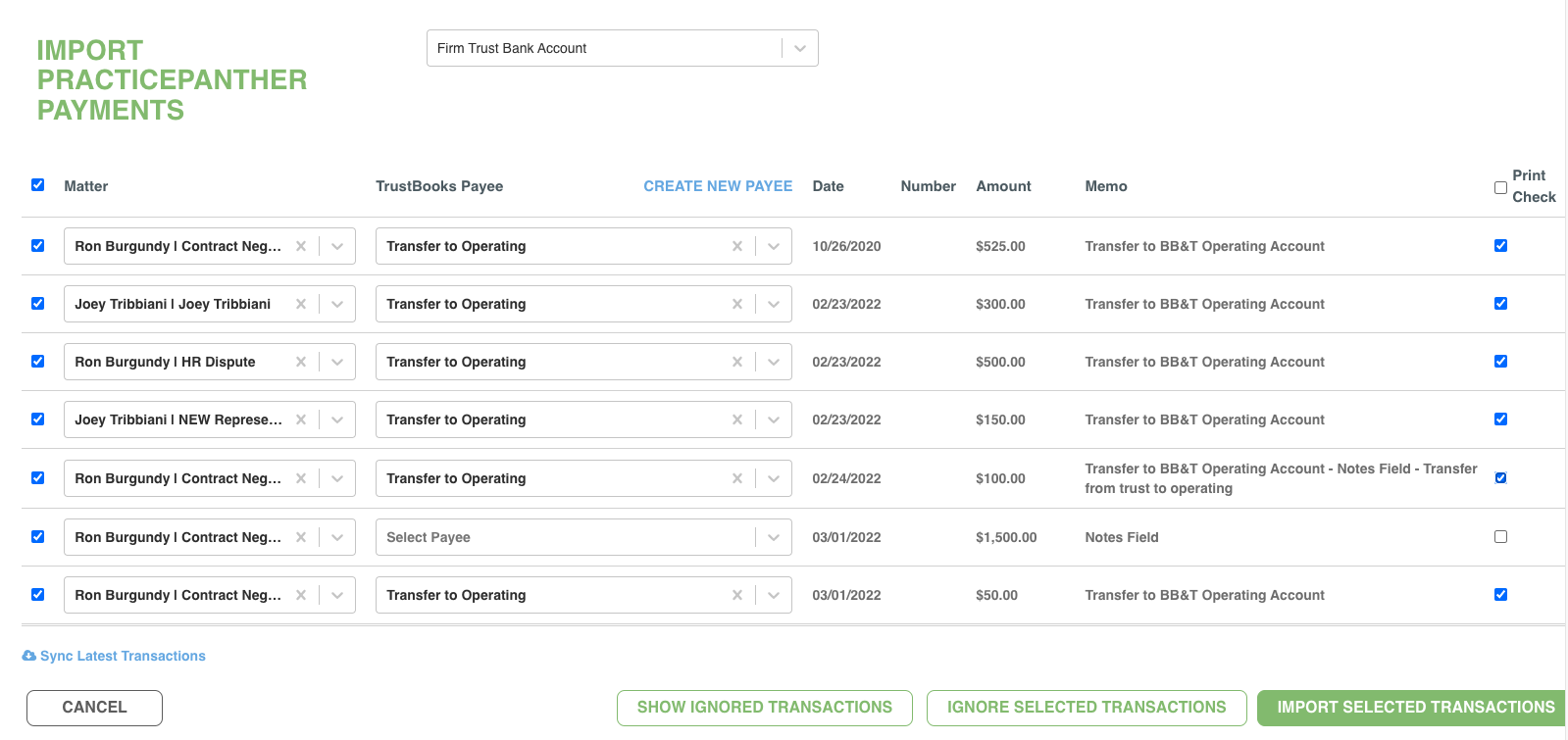

Depending on the type of matter, you may require the client to provide money for future costs. You’ll want things like court filing fees or private investigator fees to be paid by the client beforehand so you’ll have the money when the time comes.

Since these advance payments haven’t been incurred, you’ll need to keep these funds in the trust account. Once it’s time to file your case or pay the private investigator’s invoice, then you’ll use these advanced funds.

Refundable vs. Non-Refundable

With the exception of true retainers, all fees you receive are refundable. Even if you call it non-refundable in your client agreement. All advanced fees and costs are available for a refund until you’ve earned or incurred the cost.

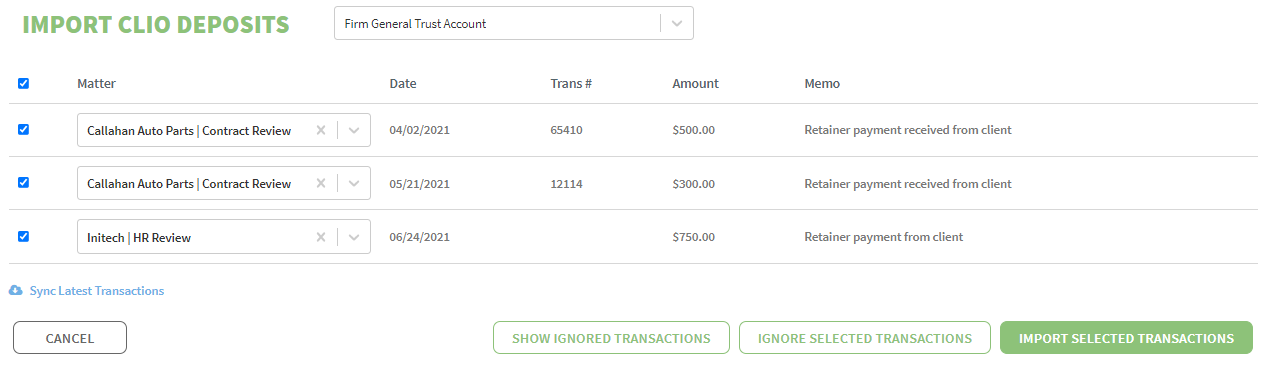

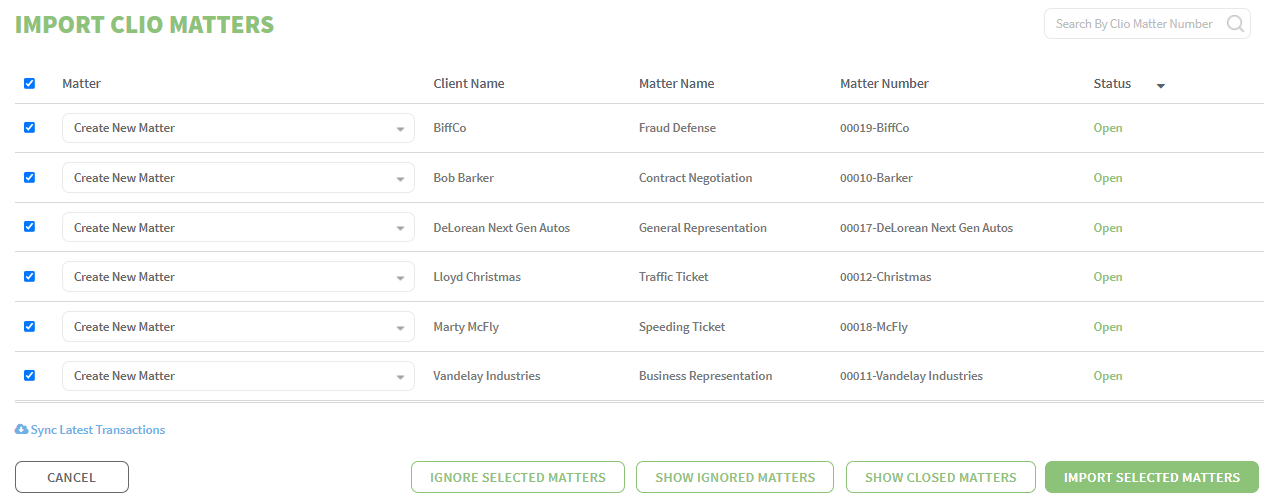

TrustBooks helps you keep your trust account in order. Using our specially designed software made exclusively to help attorneys properly manage their trust account will make you more efficient and less worried about making a mistake. Schedule your free demo now.

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. A Lawyer’s Guide to Client Trust Accounts created by the State Bar of Texas was the source of this information.