Trust accounts: all attorneys have them and most attorneys hate them. You’re focused on providing your clients with great service, and recordkeeping for your trust account isn’t something you regularly think about. But you know you have to maintain adequate records to stay in the good graces of The Florida Bar. Chapter 5 of The Florida Bar rules is where you’ll find the regulations that govern trust accounts and we’ve summarized the required records you’ll need to keep.

1. Separate Bank Account

You need to maintain a separate bank account for trust monies. The account should be in the name of the lawyer or law firm and must be clearly labeled and designated as a “trust account”.

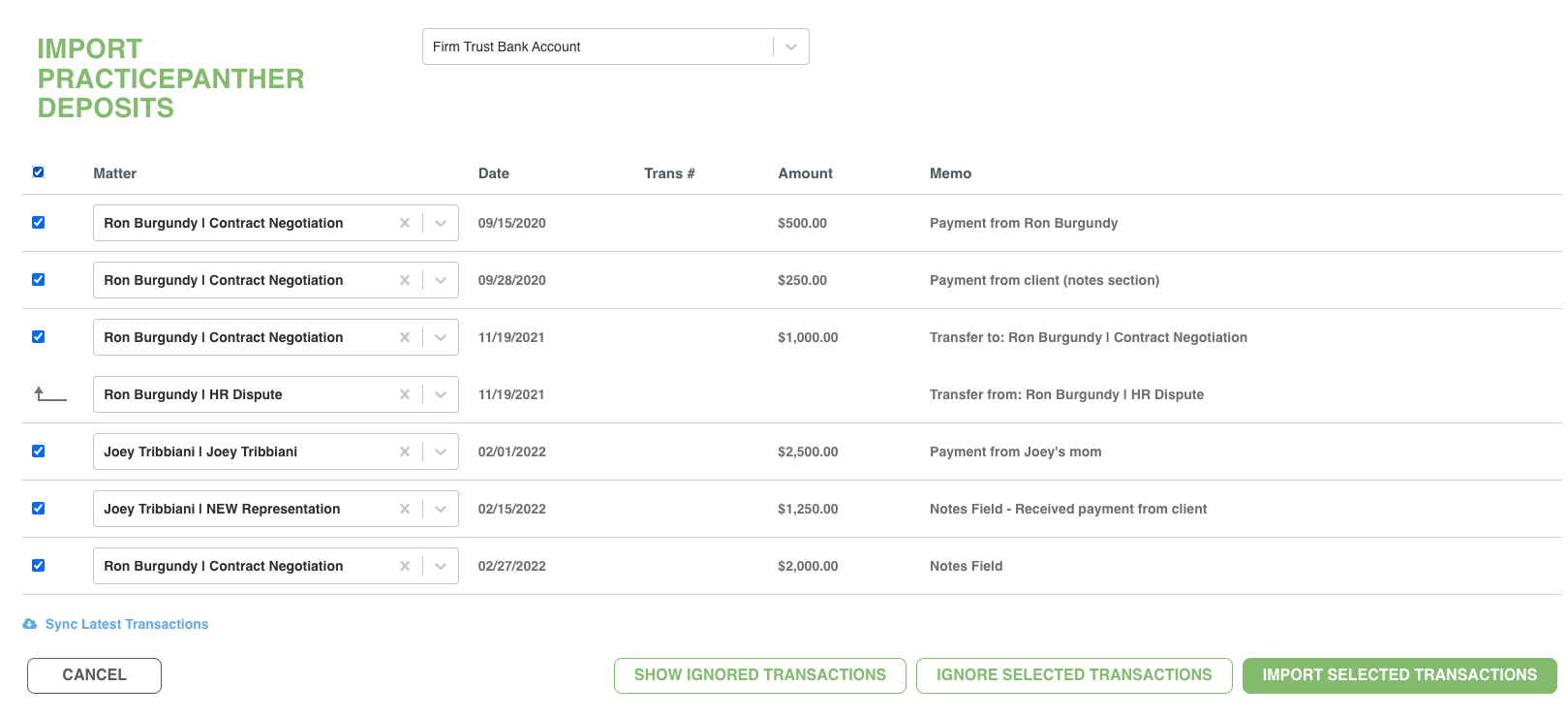

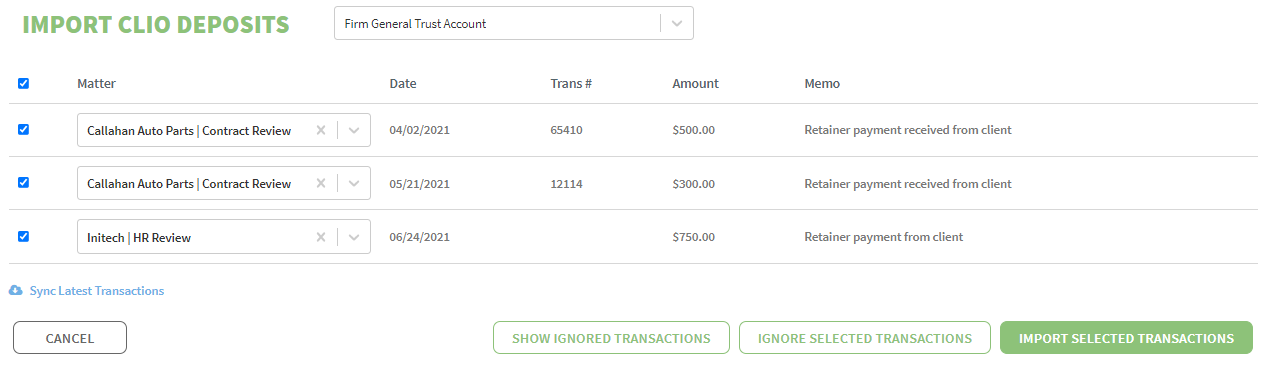

2. Deposit Slips

Deposit slips must contain the:

- date the money was received,

- source of the money, and

- client that the money is for

If you receive trust money in cash, you’ll need to maintain a separate cash receipt book that contains this same information.

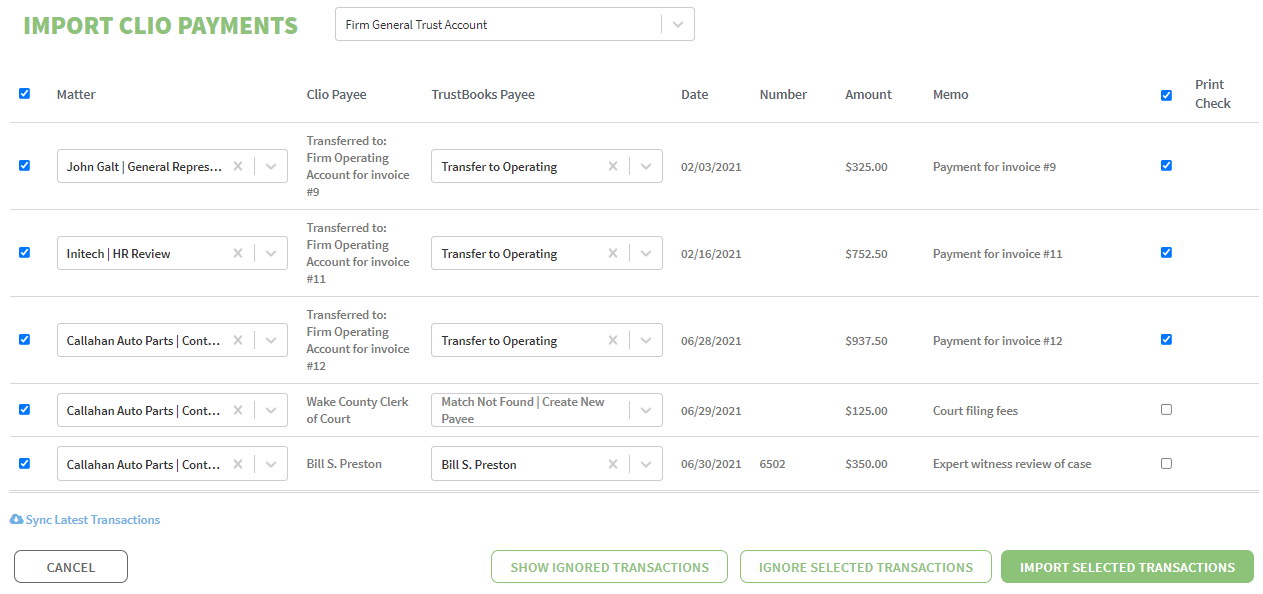

3. Canceled Checks

You’ll need to keep your canceled checks which must:

- be consecutively numbered,

- include all endorsements and any other data or tracking information, and

- clearly identify the client or case number in the memo line of the check

4. Wire Transfers

If you receive payments to or make payments from your trust account using a wire transfer, be sure to include the:

- client or case number,

- purpose of the wire transfer,

- receiving and sending banks’ names and routing numbers,

- receiving and sending account holders’ name, address, and account number, and

- intermediary bank name and routing number, if applicable

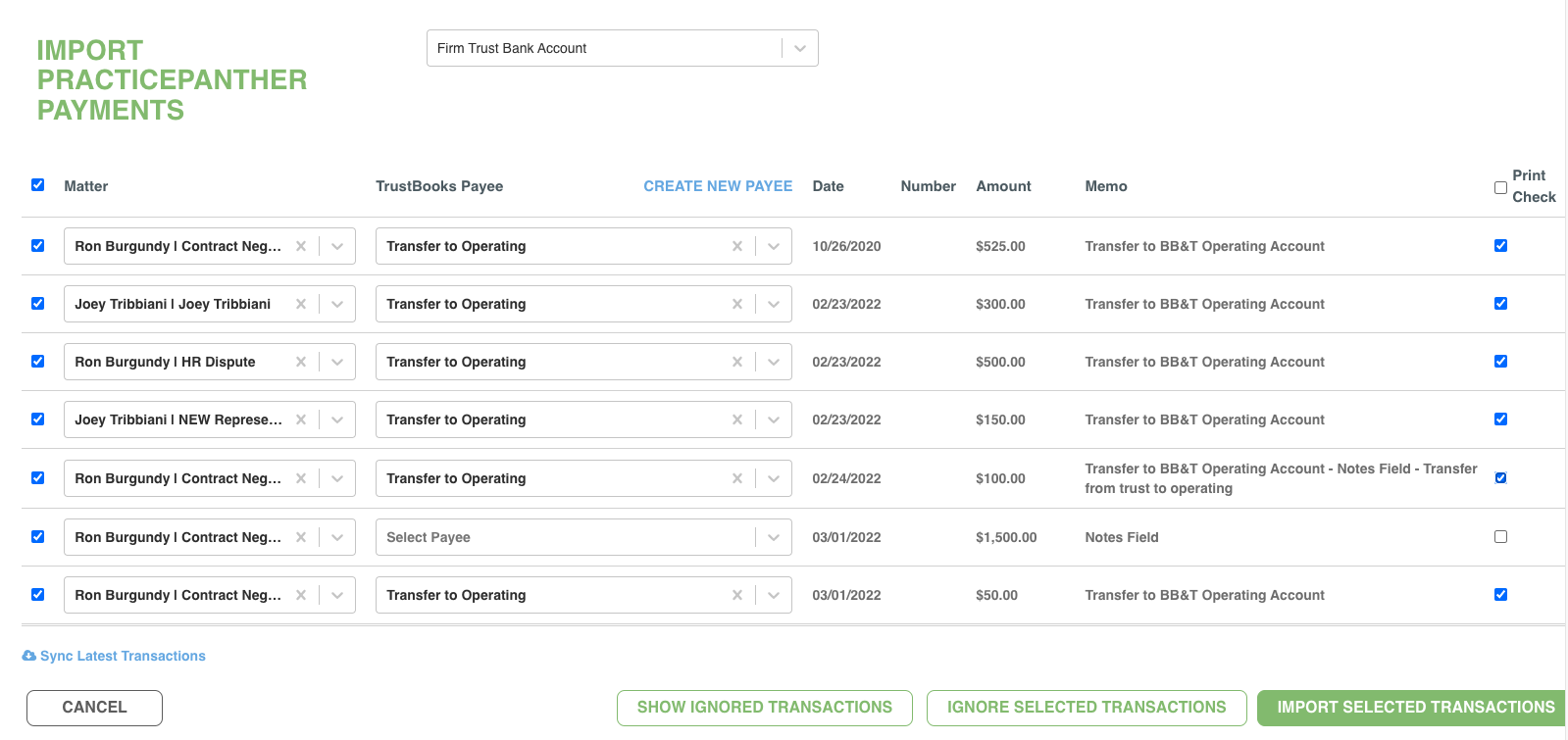

5. Other Payments or Transfers

When you make transfers out of your trust account, you need to keep documents to support the transfers. Be sure to include the:

- name of the person authorizing the transfer,

- name of the recipient,

- bank confirmation that shows the trust account number as the source of the transfer, and

- date and time the transfer was completed

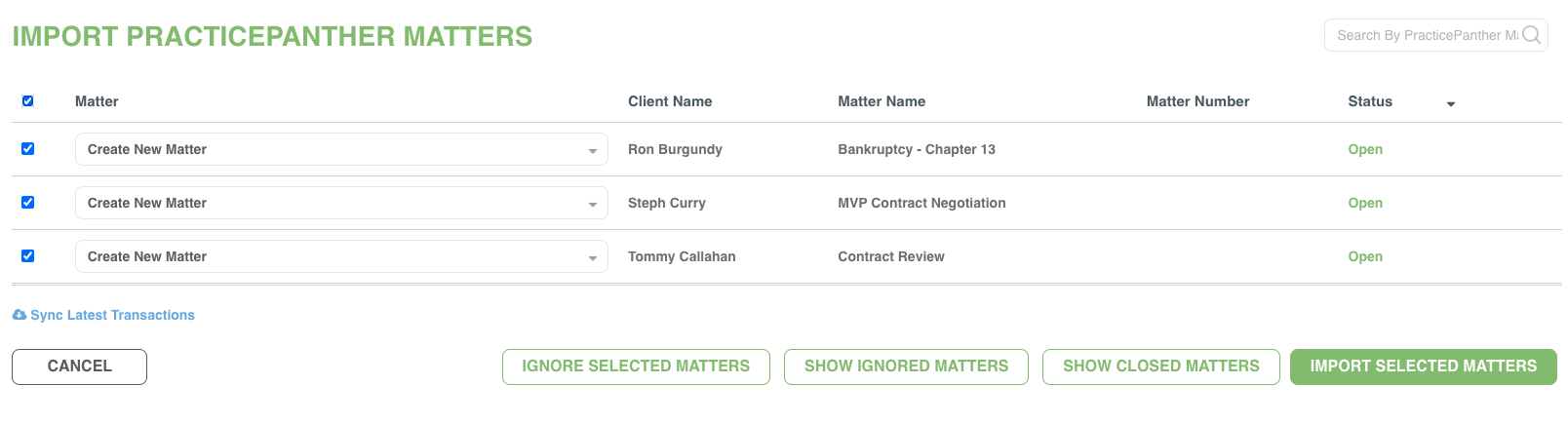

6. Trust Ledger

You’ll need to keep your trust ledger up to date. This ledger should log receipts, disbursements, transfers, and account balances. You’ll also want to keep track of the following:

- the name of the client for which trust money was received, disbursed, or transferred,

- date of all transactions,

- check number for all disbursements, and

- reason for all transactions

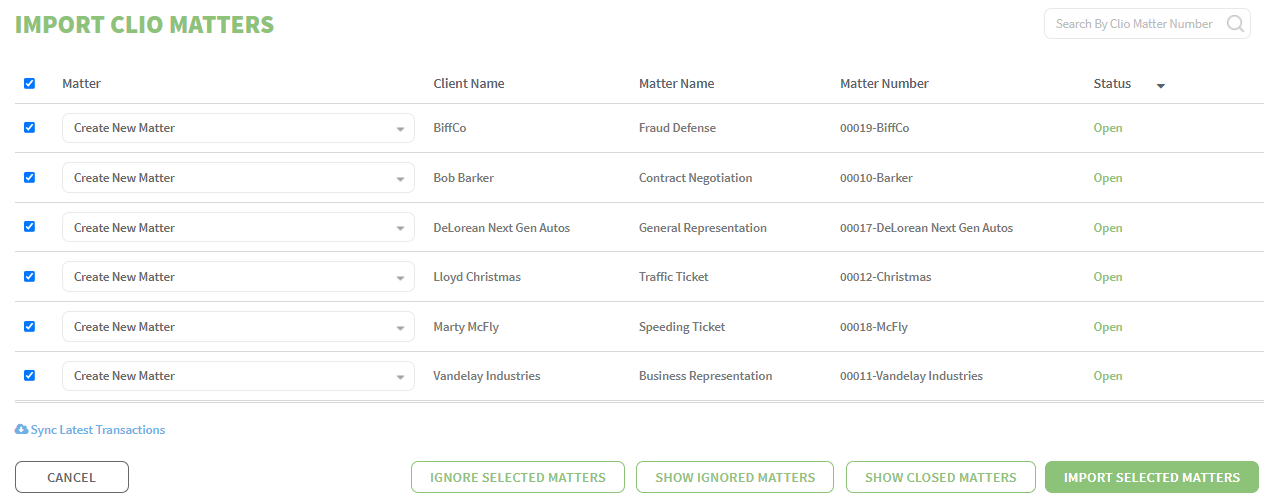

7. Client Ledger

You’ll also need to keep track of your clients’ trust transactions. A separate page should be maintained for each client that shows all receipts, disbursements, transfers, and ending balance. Just like your trust ledger, you’ll want to keep track of the same details in your client ledger.

8. Bank Statements

Don’t forget to keep copies of all bank statements for your trust account. You’ll need to keep them for at least six years. The Florida Bar allows you to keep digital copies of all the required documents so long as they contain all the original information and can be produced when required.